How to Trade Crypto in KuCoin

Spot Trading

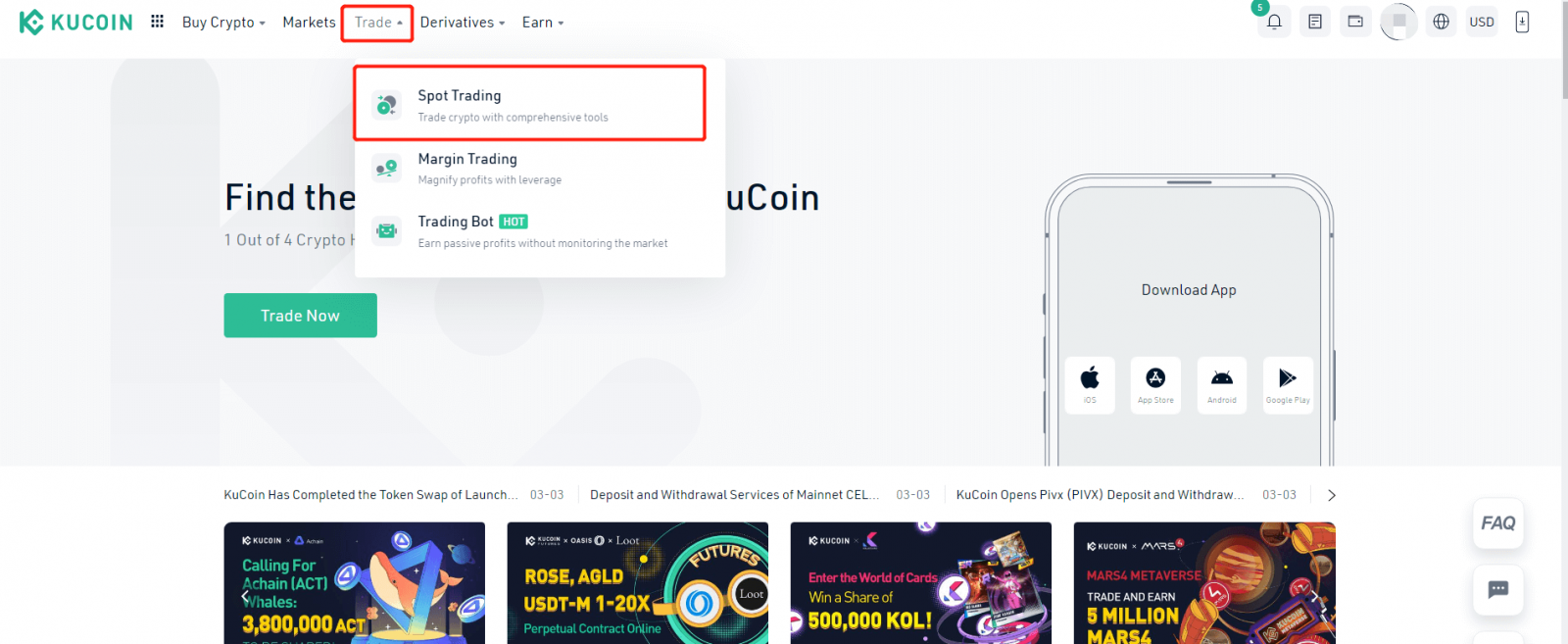

Step 1:Log in to www.kucoin.com, and click on the ‘Trade’ tab, then click ‘Spot Trading’.

Step 2:

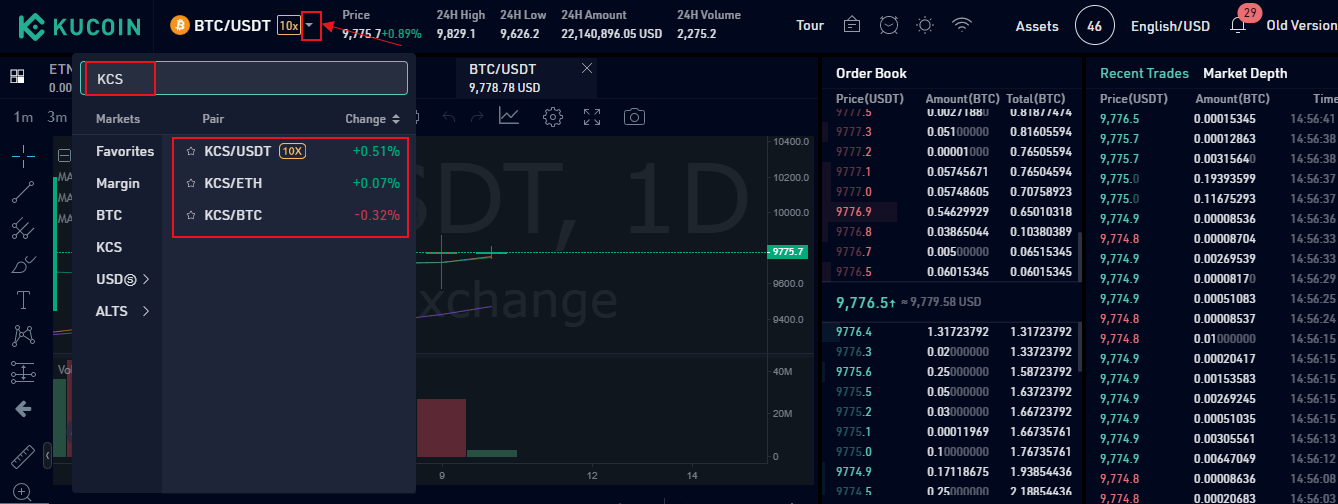

You will be redirected to the trading market. Depending on which tab you click on, you will see different markets. The options are Stable Coin (USDⓈ), Bitcoin (BTC), KuCoin Token (KCS), ALTS (Includes Ethereum (ETH), and Tron (TRX)), and several hot markets. Not all tokens are paired into every market, and the prices may vary depending on the market you are looking at.

If you would like to use BTC to buy KCS, please select the BTC market and use the search box to find KCS. Click on it to enter the KCS/BTC trade pair interface.

Step 3:

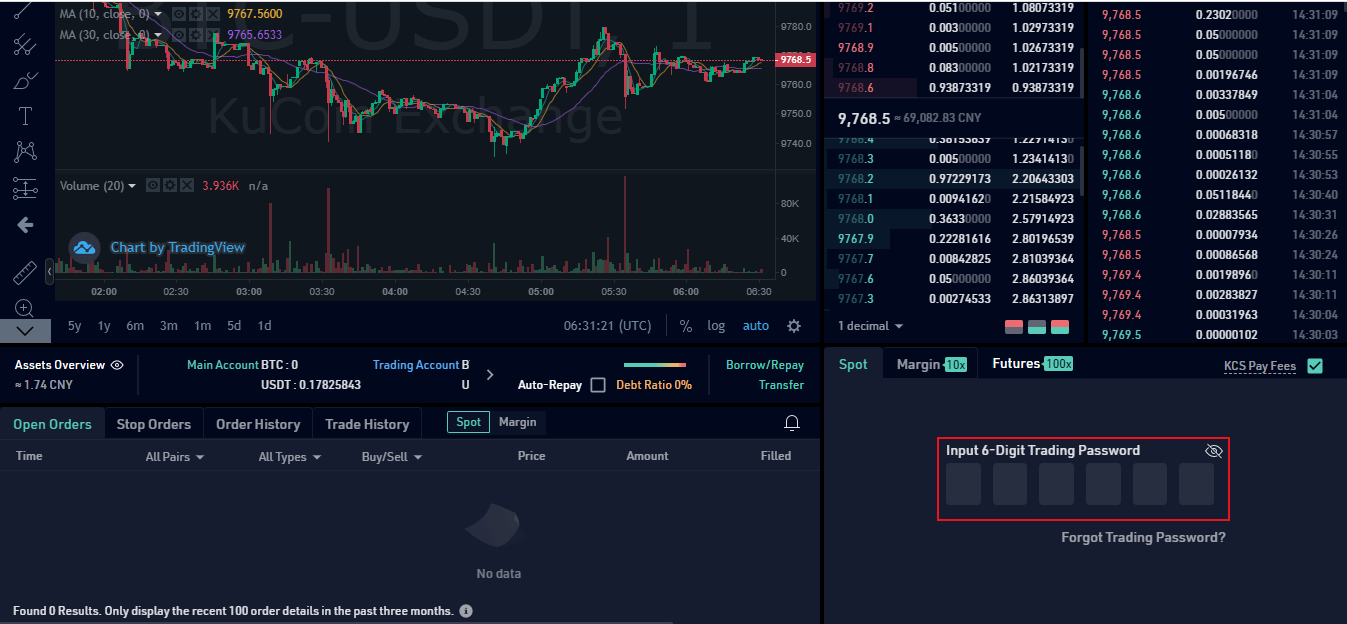

Before trading, you are required to enter your trading password for security. Once you enter it, you will not need to enter it again for the next 2 hours. It is highlighted in the red box below.

Step 4:

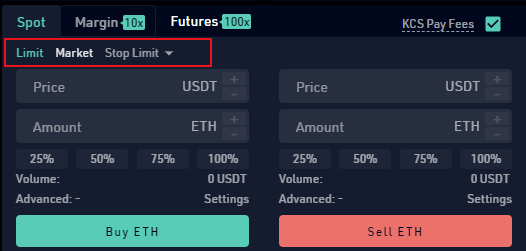

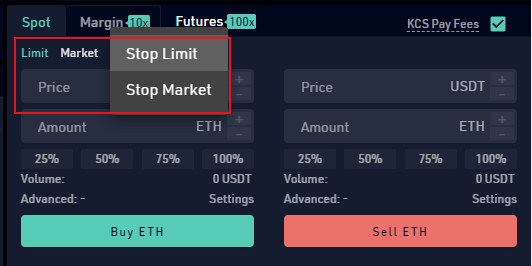

Choose the order type and enter your order details. KuCoin offers four order types. The description and operation of these order types are detailed as follows:

1. Limit Order: A “Limit Order” is an order placed to buy or sell a specified quantity of assets at a specified limit price or better. This involves setting the ideal commission price and quantity.

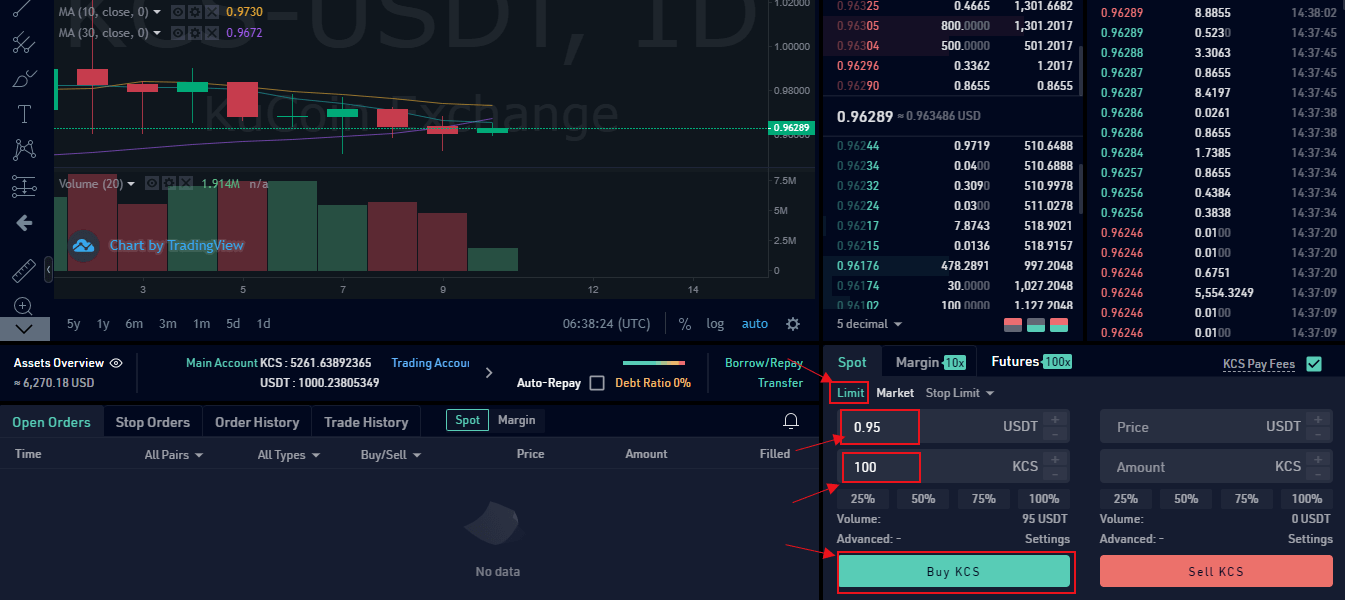

For example, if the current market price for KCS is 0.96289 USDT and you plan to buy 100 KCS when the price drops to 0.95 USDT, you can place the order as a Limit Order.

Operation Steps: Select “Limit Order” on the trade portal/interface, enter 0.95 USDT in the ‘Price’ box, and enter 100 KCS in the ‘Amount’ box for the quantity. Click “Buy KCS” to place the order. The order will be filled no higher than 0.95 USDT with a limit order in this case, so if youre sensitive to the filled price, choose this type!

What price should you input in the limit order? On the right side of the trade page, youll see the order book. In the middle of the order book, it is the market price (the last price of this trading pair). You can refer to that price to set your own limit price.

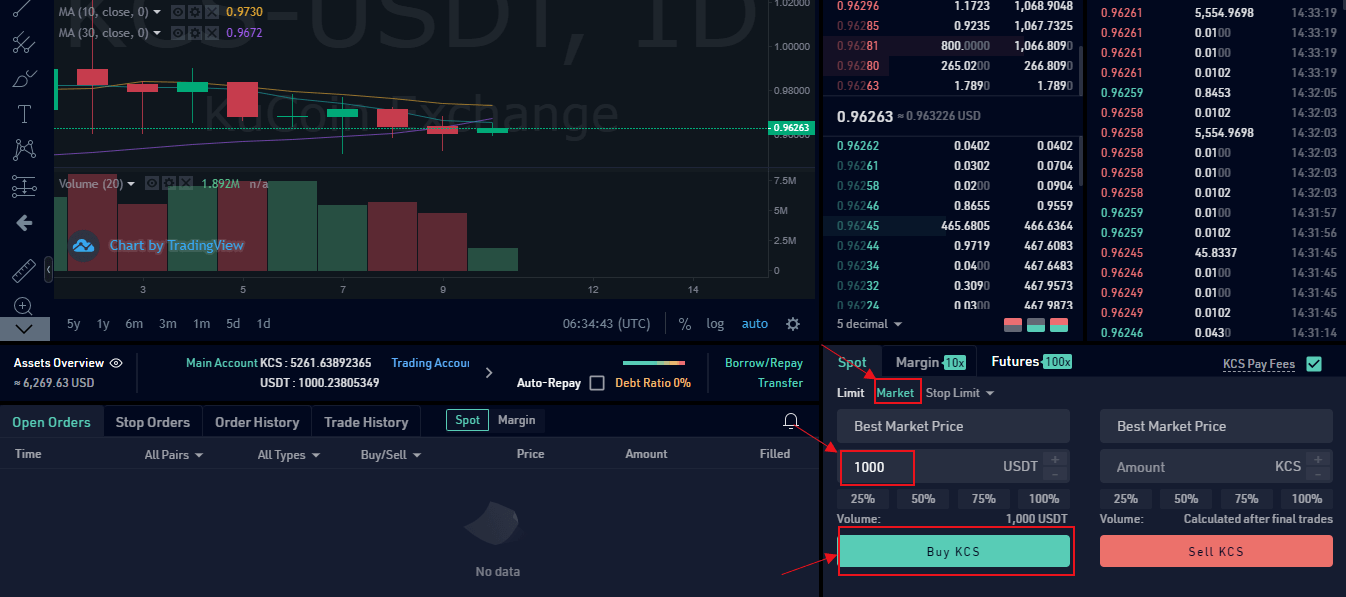

2. Market Order: A “Market Order” is an order placed to buy or sell a specified quantity/amount of assets at the best available price in the current market. In this case, the commission price is not set. Only the order quantity or amount is set, and the purchase is made by the set quantity or amount after the purchase.

For example, if the current market price for KCS is 0.96263 USDT and you plan to buy KCS worth 1,000 USDT without setting the prices. You can place the order as a market order. Market orders will be completed immediately, which is the best way to buy or sell quickly. So if youre not very sensitive with the filled price and want to trade quickly, choose this type!

Operation Steps: Select “Market Order” on the trade portal/interface and enter 1,000 USDT in the ‘Amount’ box. Click “Buy KCS” to place the order.

Tip: As the market order would usually be executed immediately, you cannot cancel the order once the order has been placed. You may check the trading details in “Order History” and “Trade History”. For sell orders, it will be filled by the best available orders that will show in the buy order book until the funds you want to sell ran out. For buy orders, it will be filled by the best available orders that will show in the sell order book until the funds you used to buy tokens ran out.

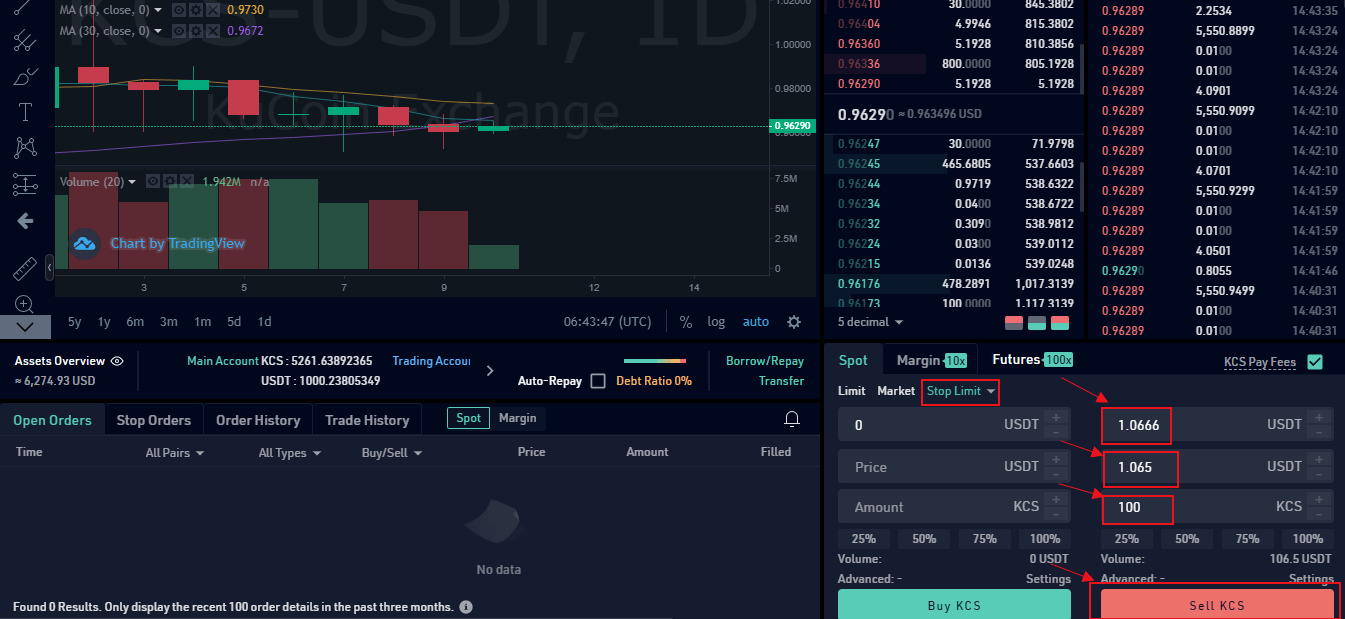

3. Stop Limit Order: A "Stop-Limit Order” is an order placed to buy or sell a preset quantity of assets at a preset limit price when the latest price reaches the preset trigger price. This includes setting the ideal commission price and quantity, as well as the trigger price.

For example, if the current market price of KCS is 0.9629 USDT, and you assume the support price will reach 1.0666 USDT and would not continue to increase when it breaks through the support price. Then you could sell it when the price reaches 1.065 USDT. However, as you are likely not able to follow the market 24/7, you could place a stop-limit order to prevent gaining more losses.

Operation Steps: Select “Stop Limit" Order, enter 1.0666 USDT in the ‘Stop Price’ box, 1.065 USDT in the ‘Price’ box, and 100 KCS in the ‘Amount’ box. Click “Sell” to place the order. When the latest price reaches 1.0666 USDT, this order will be triggered, and the 100 KCS order will be placed at a price of 1.065 USDT.

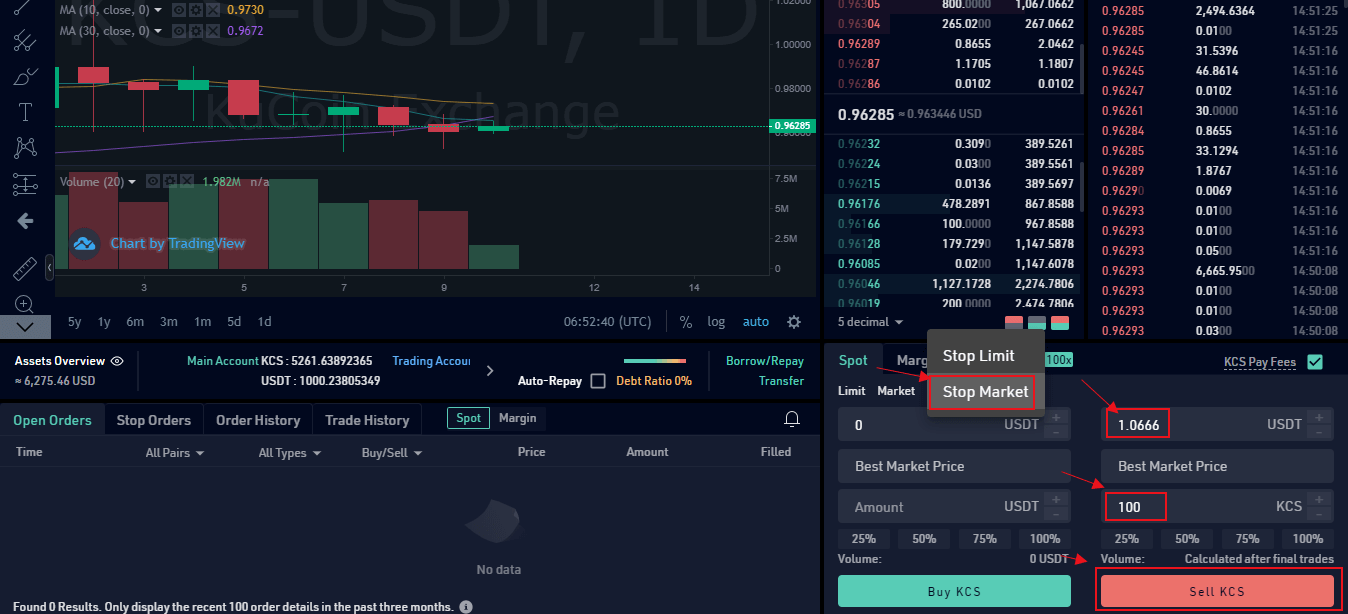

4. Stop Market Order: A “Market Stop-Loss Order" is an order placed to buy or sell a preset quantity/amount of assets at the current market price when the latest price reaches the preset trigger price. For this type, the commission price is not set, only the trigger price and the order quantity or amount are set.

For example, if the current market price of KCS is 0.96285 USDT, and you assume the support price will reach 1.0666 USDT and would not continue to increase when it breaks through the support price. Then you could sell it when the price reaches to support price. However, as you are likely not able to follow the market 24/7, you could place a stop market order to prevent gaining more losses.

Operation Steps: Select “Stop Market" Order, enter 1.0666 USDT in the ‘Stop Price’ box, and 100 KCS in the ‘Amount’ box. Click “Sell KCS” to place the order. When the latest price reaches 1.0666 USDT, this order will be triggered, and the 100 KCS order will be placed at the best market price.

Kind Reminder:

Market order price is matched by the fittest price in the current trading market. Considering the price fluctuation, the filled price to a market order will be matched in higher or lower than the current price. Please check the price and amount through on-floor orders before you place a market order.

Stop order has been upgraded from 15:00:00 to 15:40:00 on October 28, 2020 (UTC+8), in order to improve the utilization of users’ funds and provide better trading experiences. When placing a Stop Loss Order, the new system will not pre-freeze the assets in your account for the order until it has been triggered. After the Stop Orders are activated, the order rules are the same as those for Limit Orders or Market Orders. Orders might be canceled if there are insufficient funds. We suggest you do not ignore these risks in case the stop order cant be filled because of this.

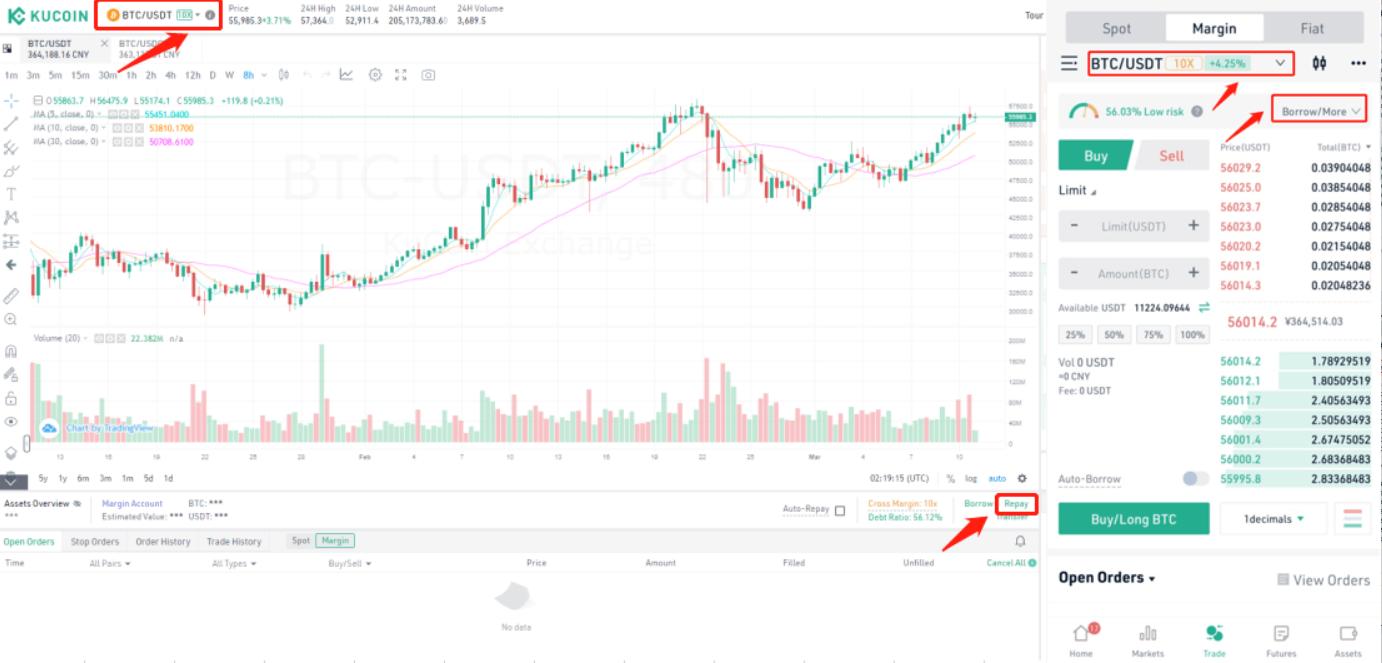

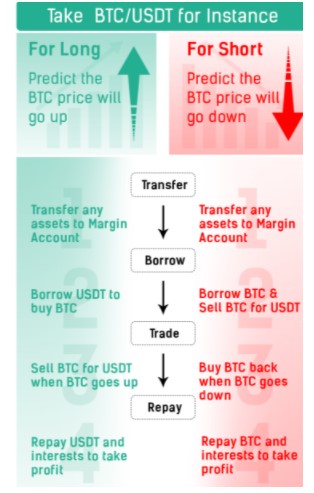

Margin Trading

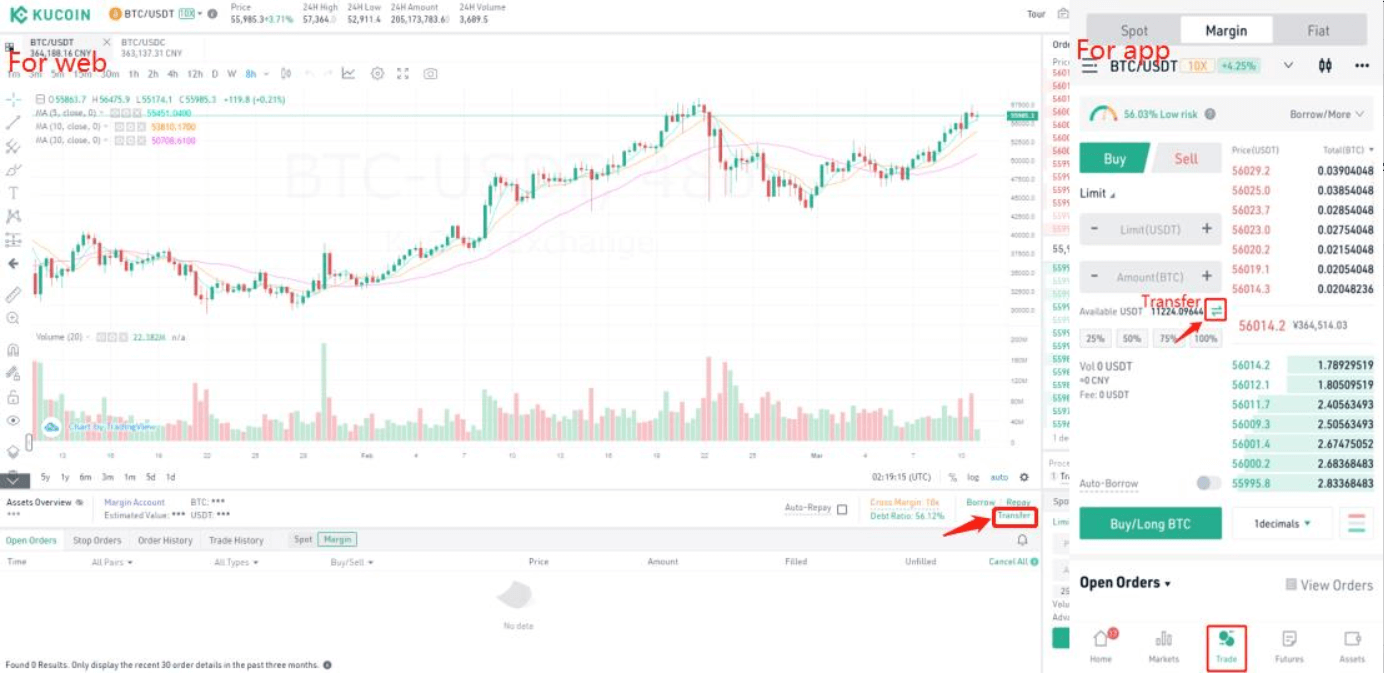

1.Transfer principal to your margin account

Note: Any currency supported on Margin trade can be transferred.

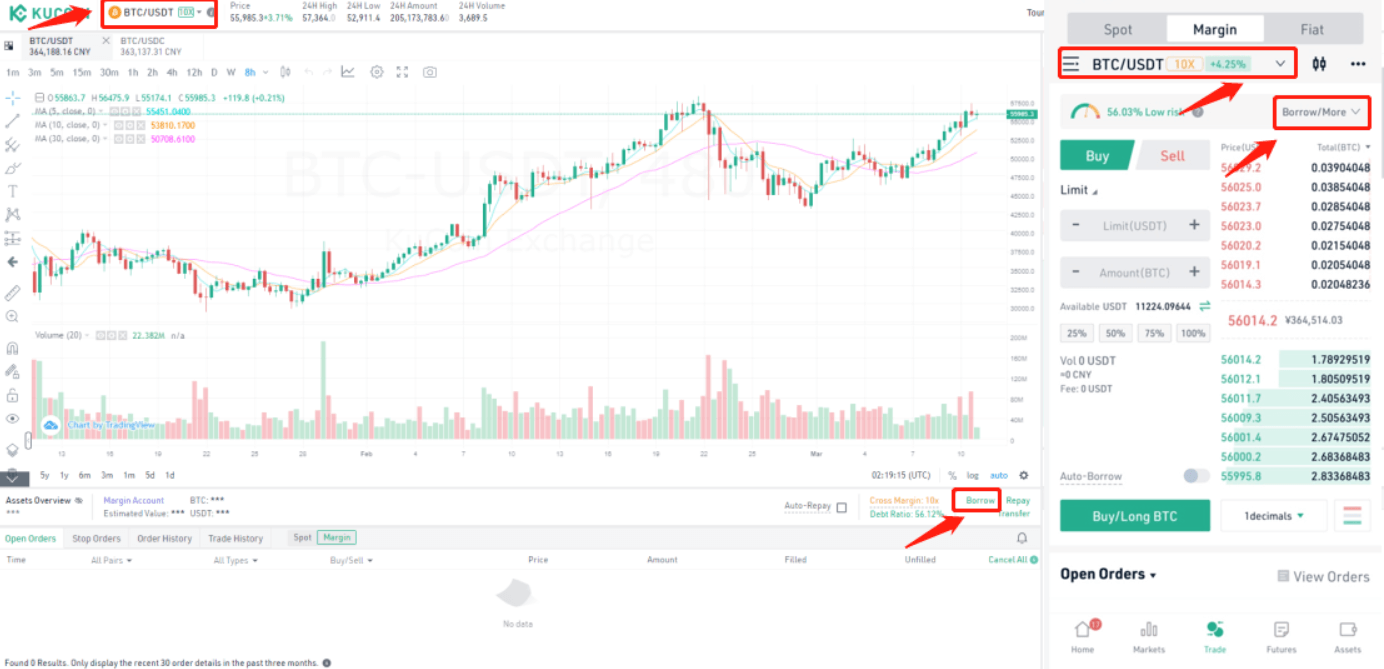

2.Borrow funds from the Funding Market

For Web For App

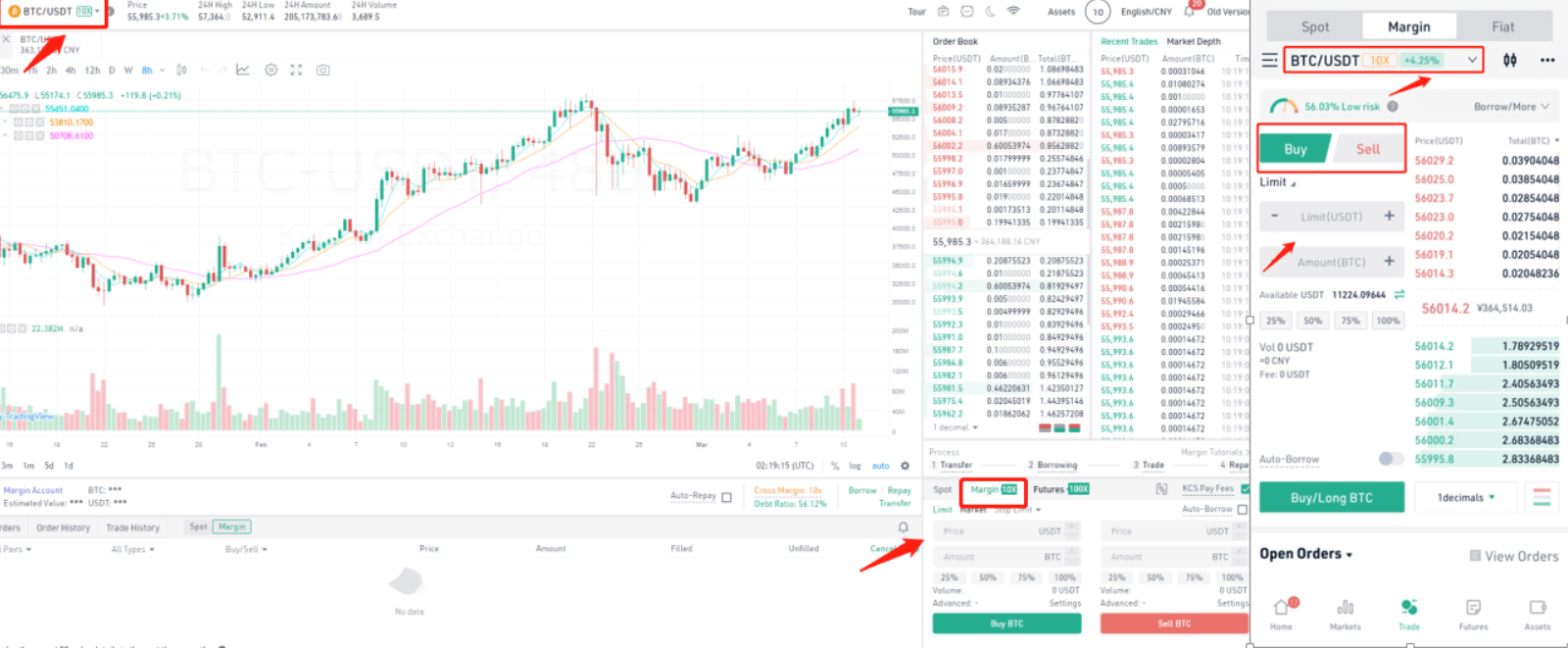

3.Margin trade (Buy long/Sell short)

Trade: Lets buy long using BTC with the BTC/USDT trading pair as an example, using the borrowed USDT to buy BTC.Close position: When the BTC price goes up, you can sell the BTC you bought before back to USDT.

Note: A margin trade works exactly the same as a spot trade and they share the same market depth.

For Web For App

4.Repay loans

Repay all the borrowed USDT as well as the interest. The remaining amount is the profit.Note:

| Can I use other tokens to repay the borrowed USDT? | What if I don’t repay after borrowing? |

|

No! You can only repay what you borrowed instead of using other tokens to repay. If your margin account does not have enough USDT to repay, you may sell other tokens to USDT, and then click the Repay button to repay. |

The system will execute the auto-renew procedure. When the borrowers debt is about to expire, the system will automatically borrow the same amount of the corresponding debt assets (which equals the remaining mature debt’s principal and interest) to continue the debt if there are insufficient corresponding assets in the borrowers account. |

For Web For App

Kind reminder: This article is based on buying long in a margin trade. If you think that the specific token will go down, at step 2, you can borrow that token then sell it short at a higher price, then buy it back at a low price to make a profit.

Futures Trading

What is KuCoin Futures?

KuCoin Futures(KuCoin Mercantile Exchange) is an advanced cryptocurrency Trading Platform that offers various leveraged Futures that are bought and sold in Bitcoin and other cryptocurrencies. Instead of fiat currencies or other cryptocurrencies, KuCoin Futures handles Bitcoin/ETH only, and all the profit and loss are in Bitcoin/ETH/USDT.

What do I trade at KuCoin Futures?

All the trading products on KuCoin Futures are Futures of cryptocurrency. Different from the spot market, you trade financial Futures with others at KuCoin Futures instead. A Futures in KuCoin Futures is an agreement to buy or sell a particular crypto asset at a predetermined price and a specified time in the future.

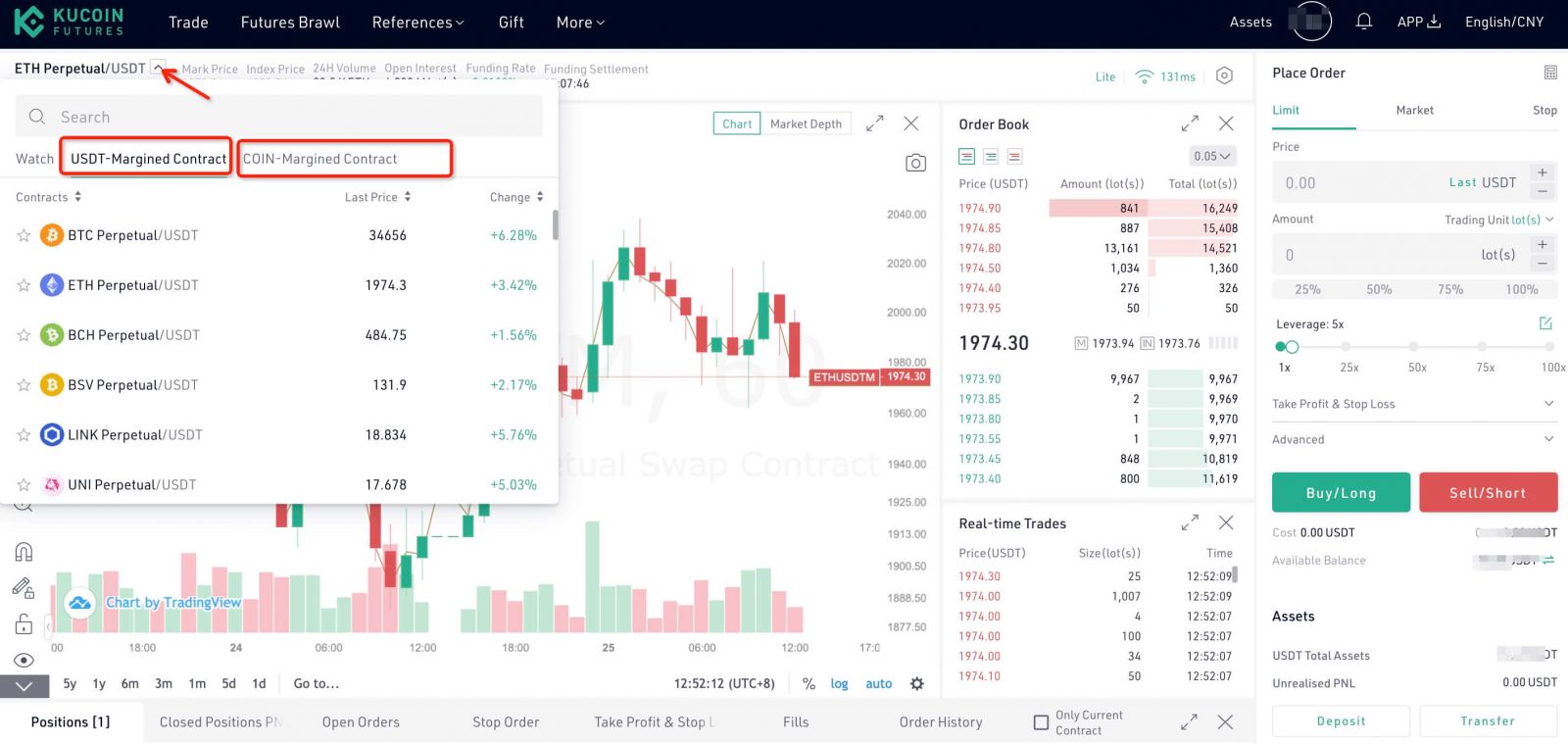

How to trade Futures at KuCoin Futures?

In simple terms, KuCoin Futures trading is a process of opening a position - getting profit/loss from the position - closing a position. Only after the position is closed will the positions profit/loss be settled and reflected in the balance. You can follow the steps in the guidance article below to start your Futures trading:The USDT-Margined Futures takes USDT as margin to exchange bitcoin or other popular Futures; while for BTC-Margined Futures and ETH-Margined Futures, it takes BTC and ETH as margin to exchange Futures.

| Type | Margin | Pnl Settlement Coin | Max Leverage | Supported Futures | Price Fluctuation |

| USDT-Margined | USDT | USDT | 100x | Bitcoin Futures | Stable, will not be influenced by USDT price fluctuation |

| BTC-Margined | BTC | BTC | 100x | Bitcoin Futures | Will be influenced by BTC price fluctuation |

| ETH-Margined | ETH | ETH | 100x | ETH Futures | Will be influenced by ETH price fluctuation |

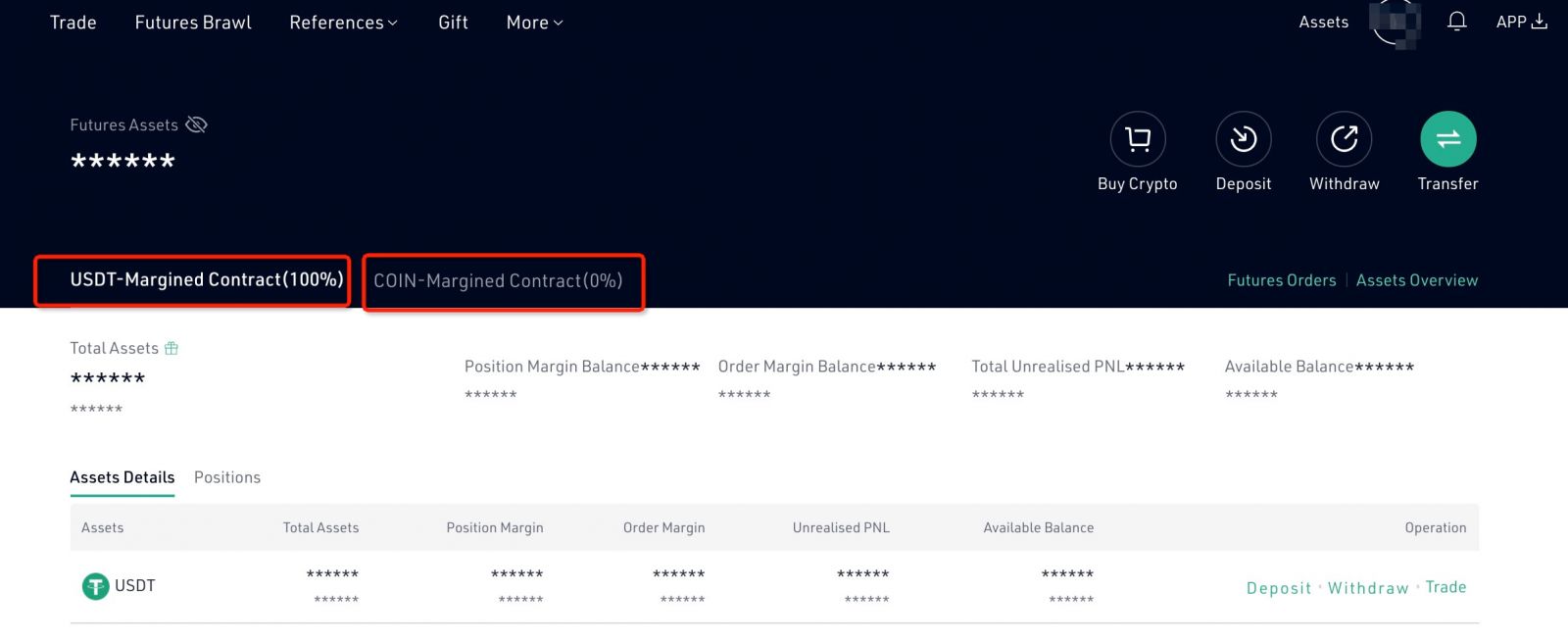

On KuCoin Futures Pro, you can freely switch between the USDT-margined Futures and COIN-margined Futures:

For Futures in the USDT-margined market, they are settled in USDT and for Futures in COIN-margined market, they are settled in coins(BTC, ETH).

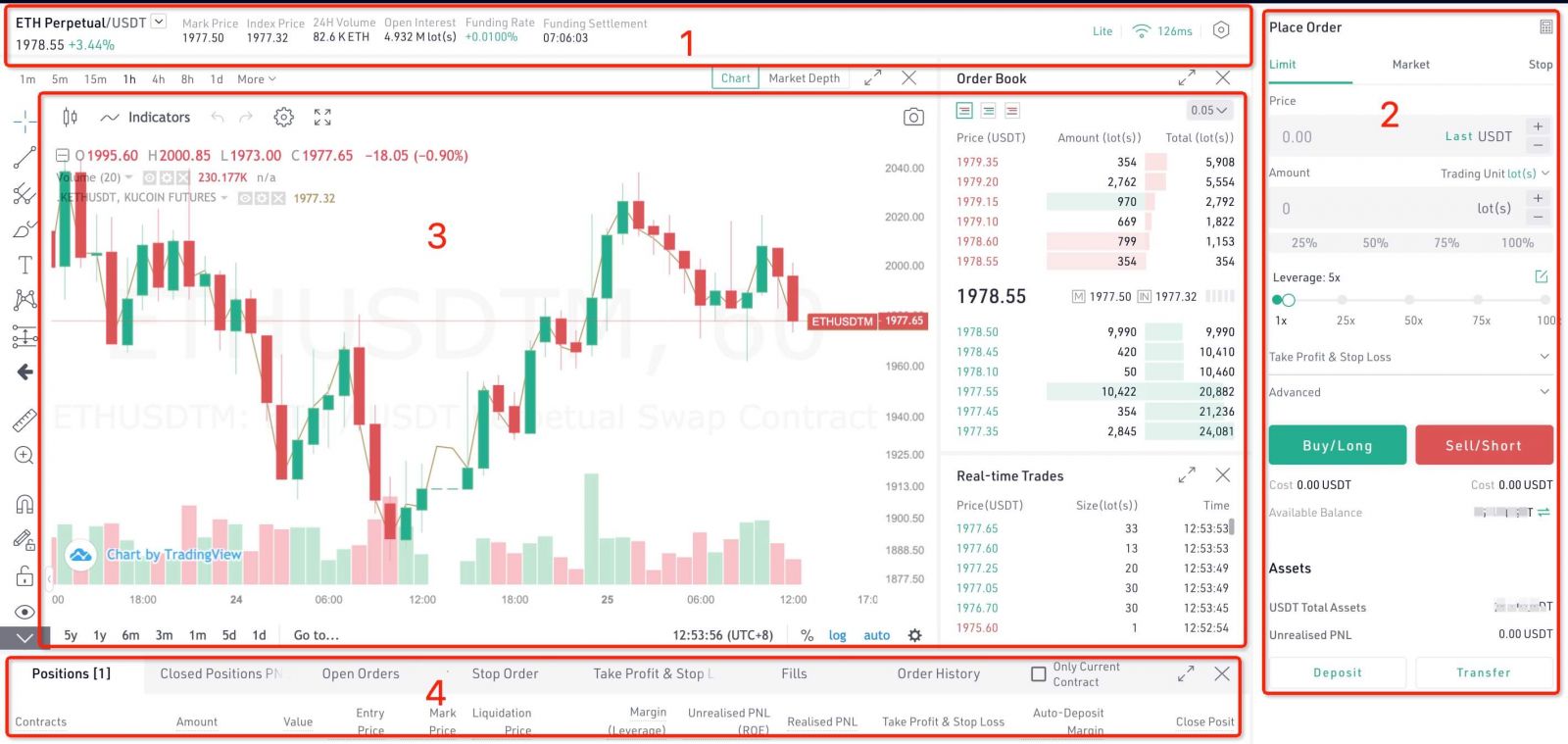

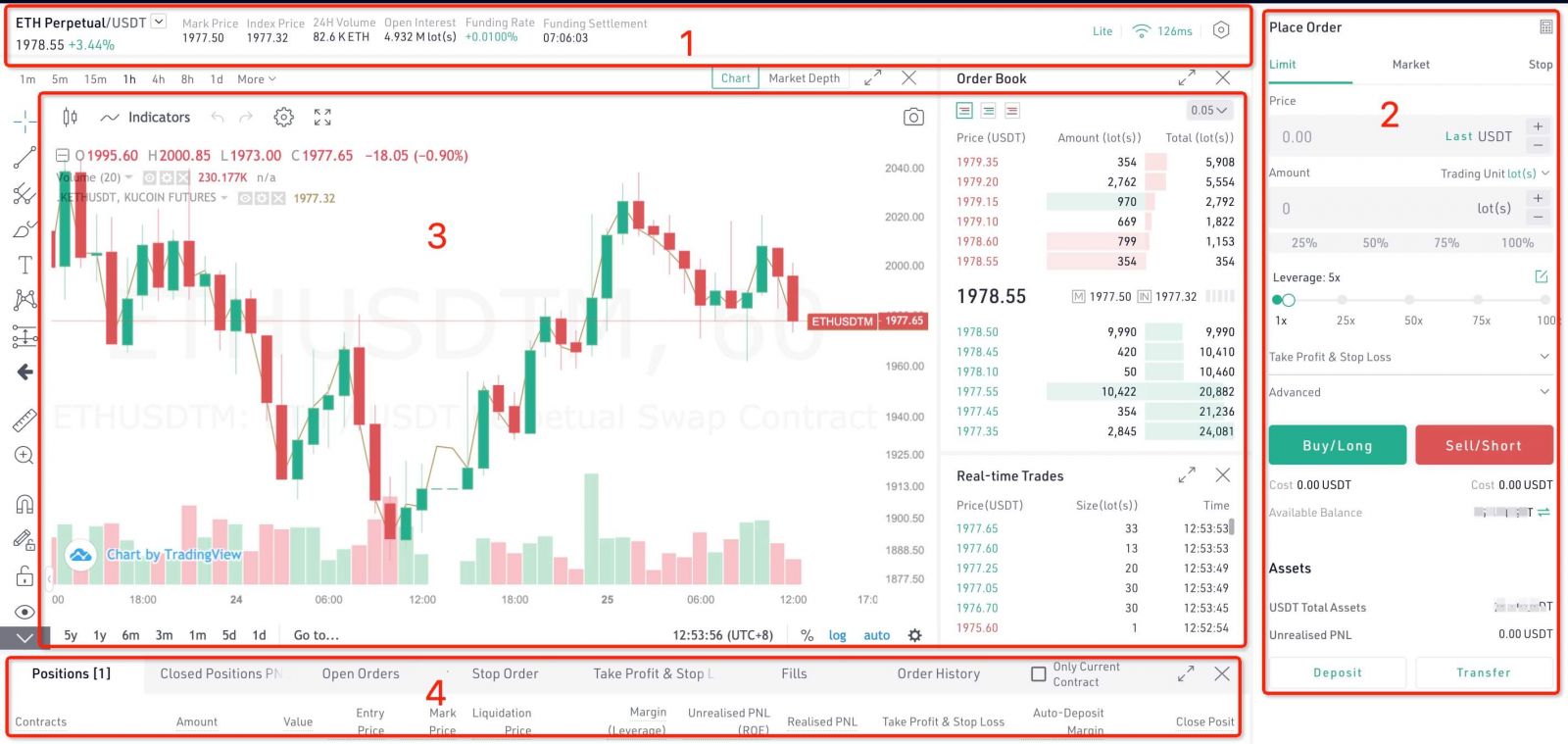

Layout Overview

New function: Here comes the Calculator! You can use it to calculate the estimated PNL, liquidation price, etc.)

2. Trade: You’re available to open, close, long or short your positions by placing orders in the order placing area.

3. Market: KuCoin Futures Pro has also offered a candlestick chart, market chart as well as the recent trade list and order book on the trading interface to display the market changes for you in full dimension.

4. Positions: In the position area, you can check your open positions and order status by just a simple click.

Trade

1. Log In and Sign Up1.2 Sign Up: If you do not have a KuCoin account, please click “Sign Up” for registration.

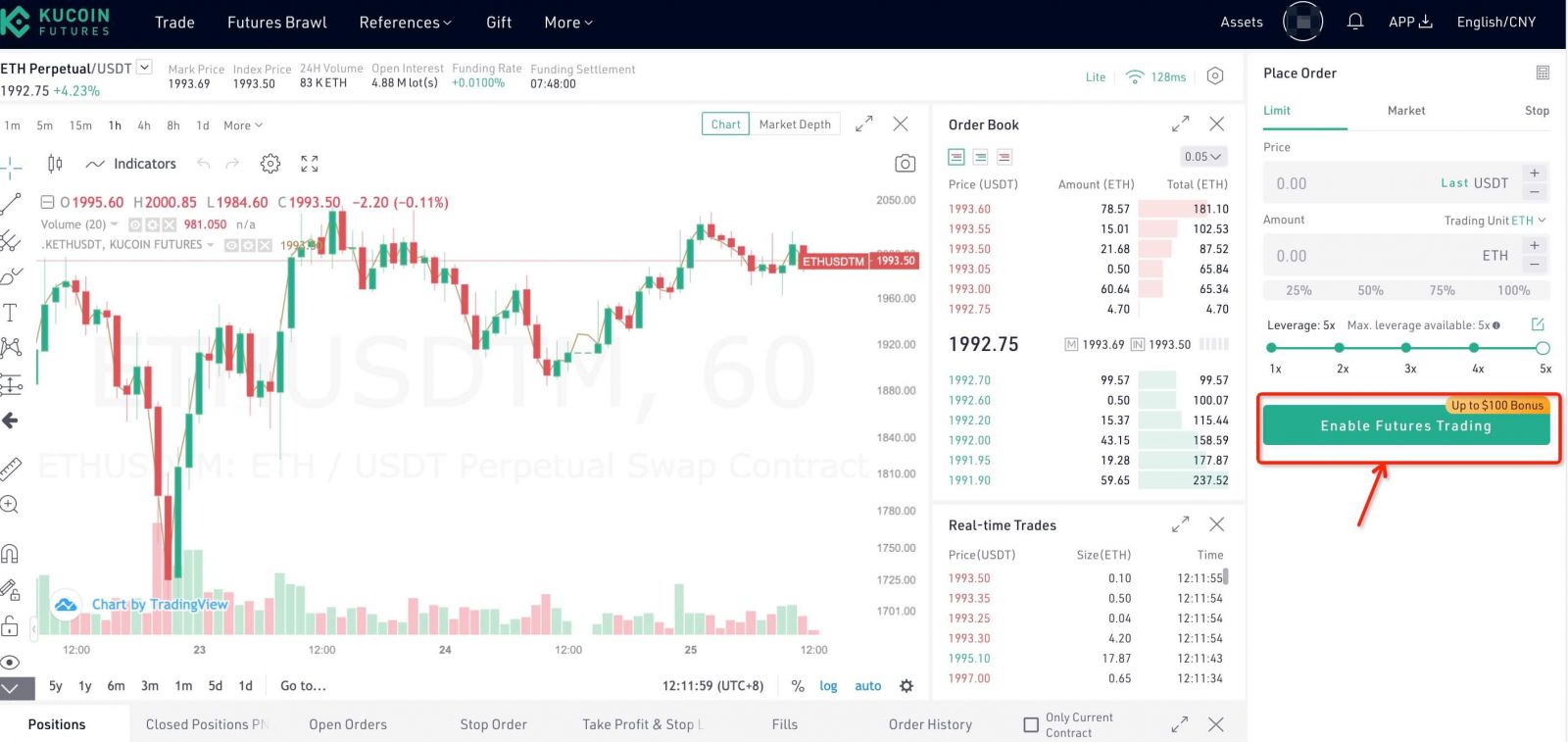

2. Enable Futures Trading

To enable Futures trading, please click the button “Enable Futures Trading” and tick “I Have Read and Agree” to proceed with the operation.

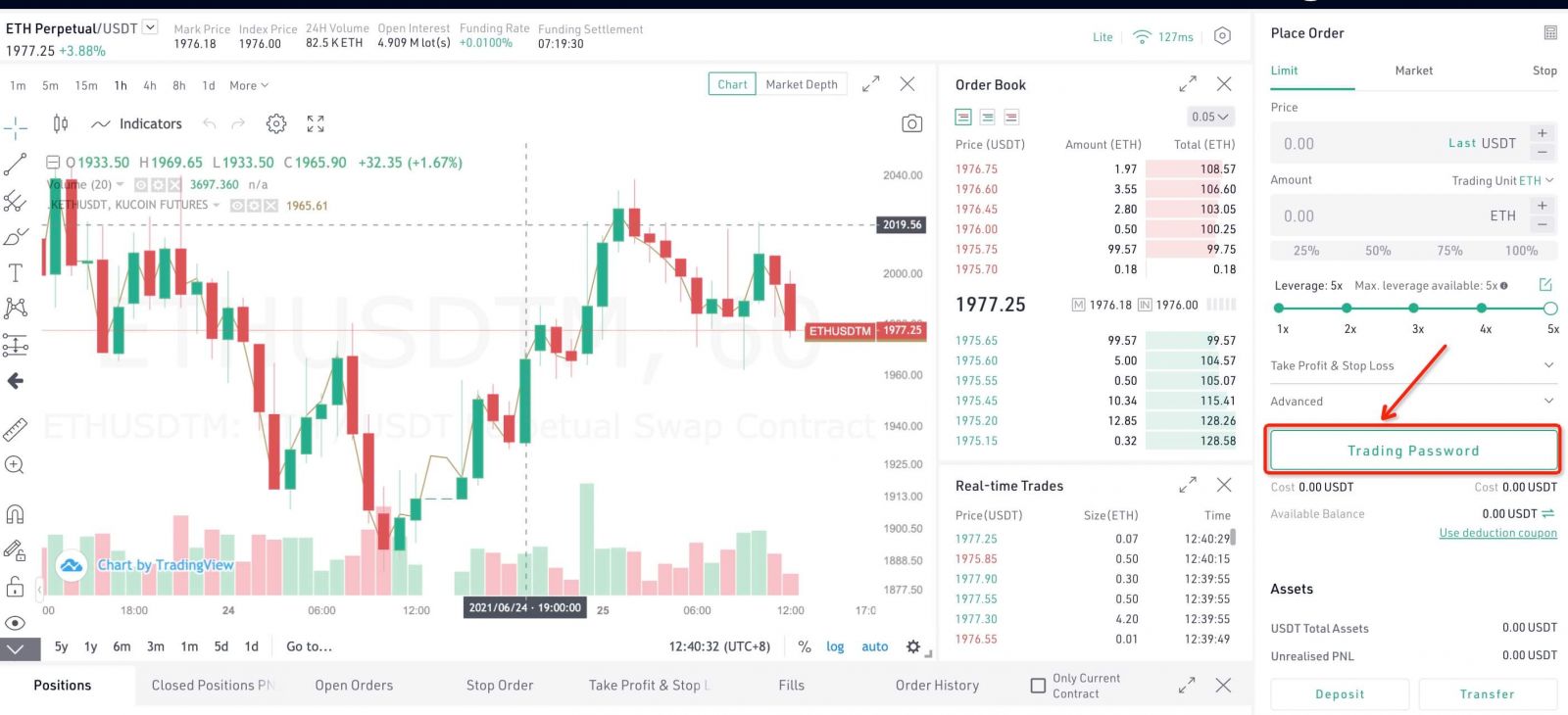

3. Set Trading Password

To ensure the security of your account and assets, please complete the setting and verification of your trading password.

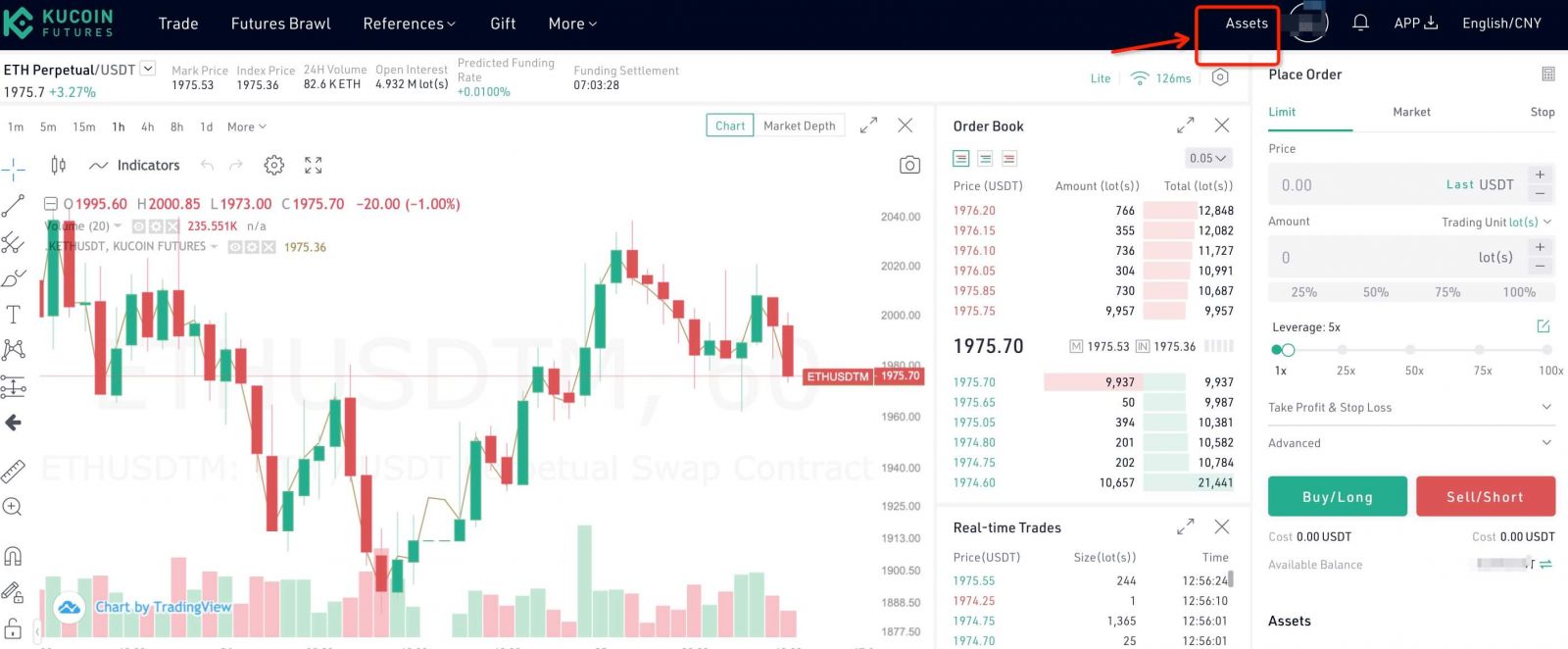

4. Futures Assets

To check your assets on KuCoin Futures Pro, click “Assets” --"Futures Assets" on the top right corner of the page and you will be redirected to the assets page.

In the assets page, you can check your total assets, the weighted BTC, USDT and ETH equity, available balance, position margin, order margin, unrealised pnl and the pnl history in your account. In the “Pnl History” part, you can check the historical profit and loss of your positions.

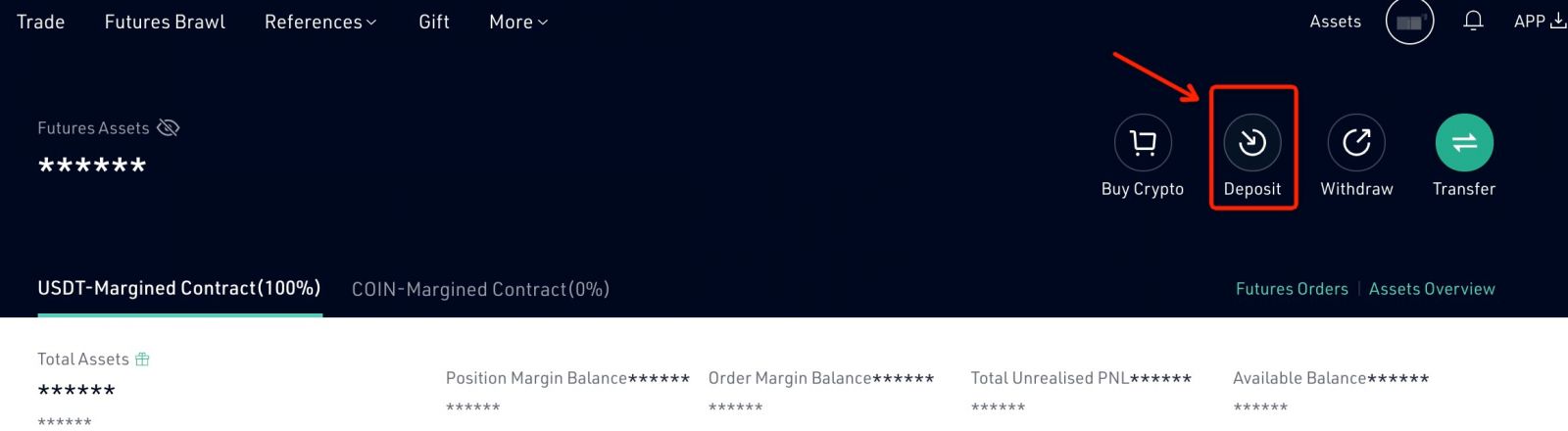

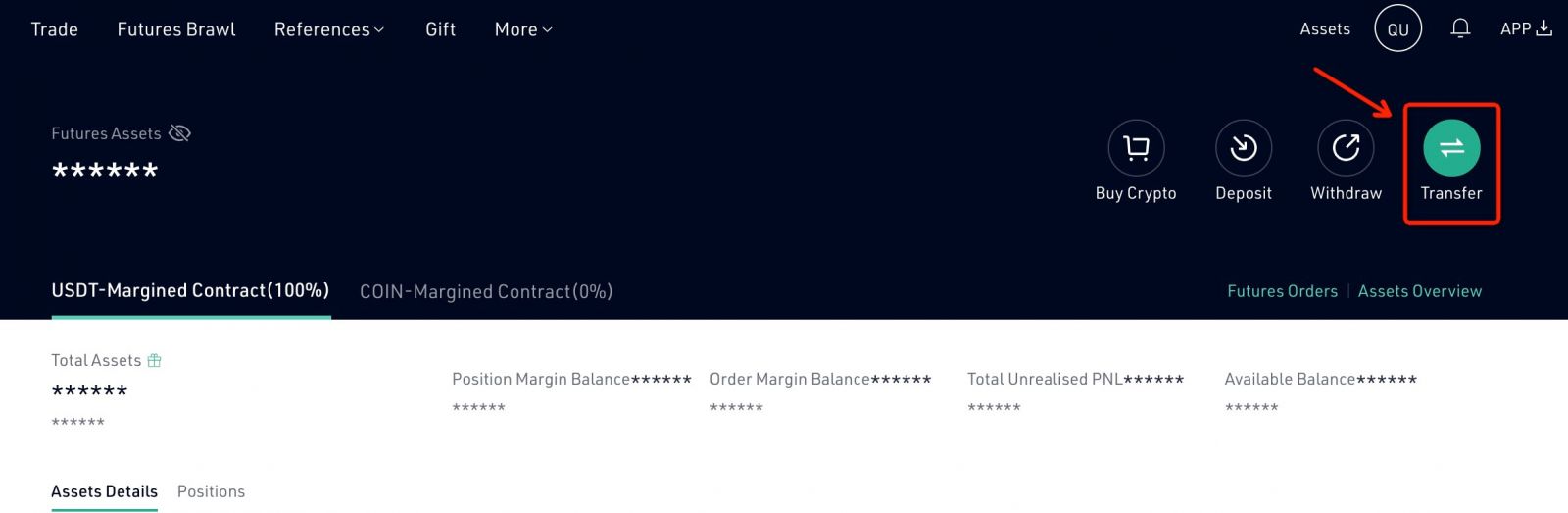

KuCoin Futures Pro offers two ways for your to deposit funds: 1) Deposit and 2) Transfer.

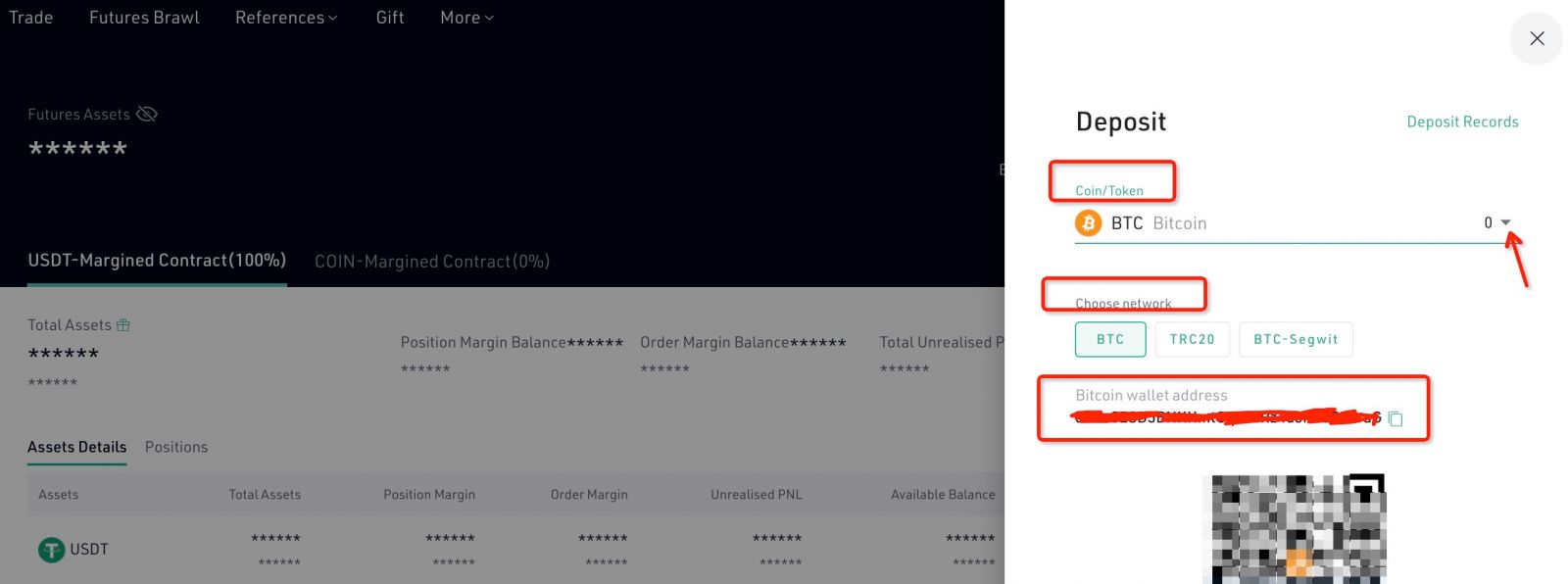

1.1 If your USDT, BTC or ETH are on another platform, you can click “Deposit” directly and deposit the USDT or BTC to the specified address. For USDT and BTC deposit, please pay attention to choose the corresponding network protocol in deposit.

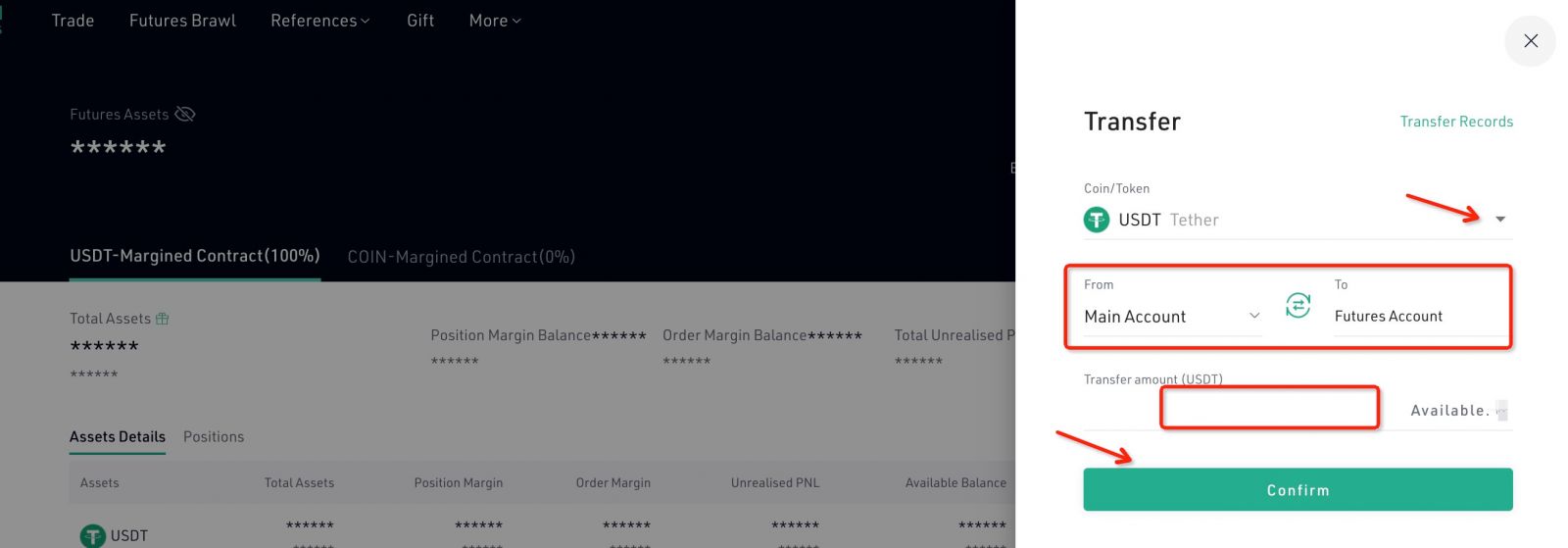

1.2 If you’ve already had USDT or BTC on KuCoin, click “Transfer” and transfer your USDT or BTC to your KuCoin Futures account to start your Futures trading.

5. Place Order

To place an order on KuCoin Futures Pro, please select the order type and leverage and enter your order quantity.

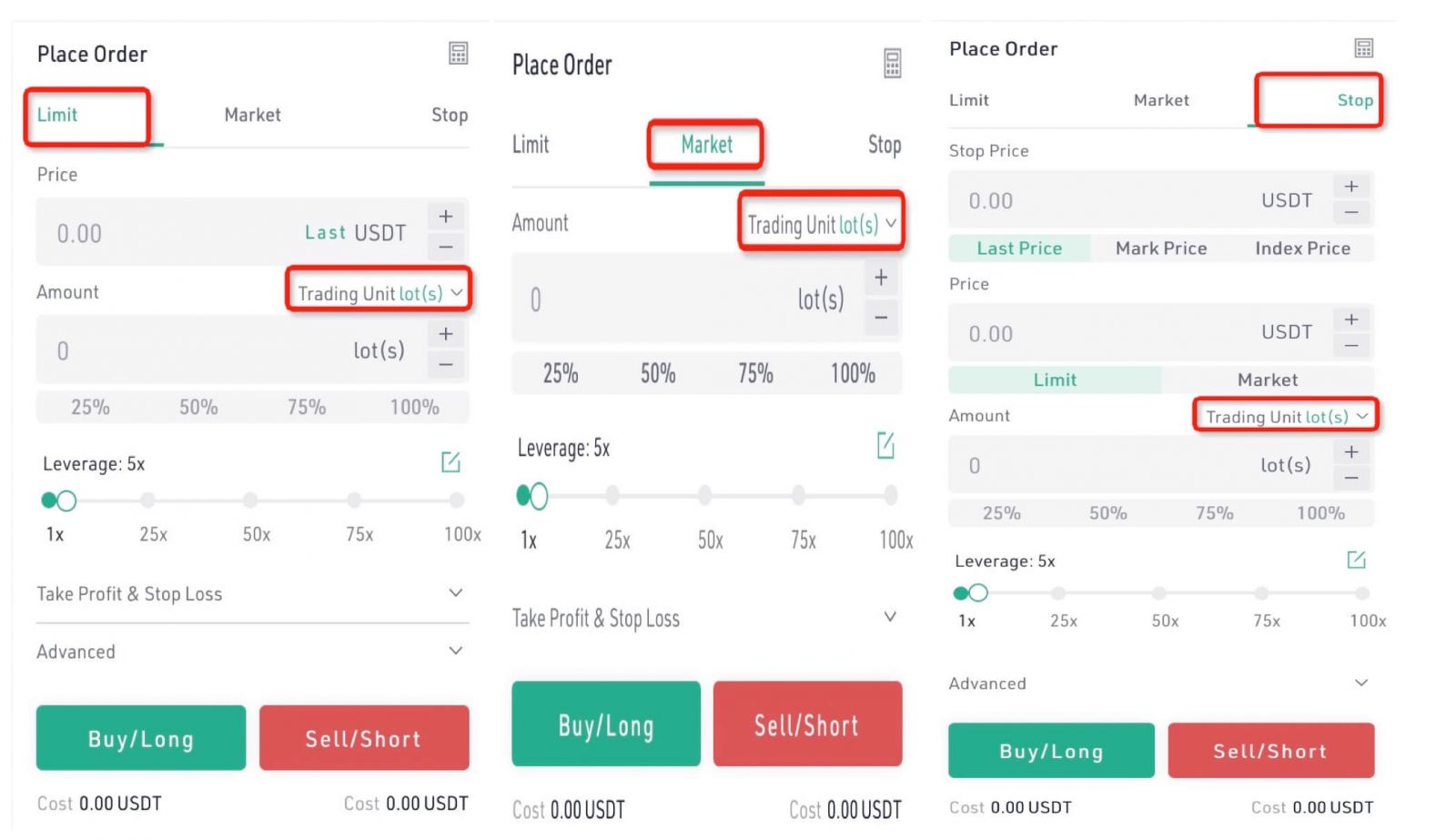

1) Order Type

KuCoin Futures supports three types of orders currently: a) limit order, b) market order and c) stop order.

1. Limit Order: A limit order is to use a pre-specified price to buy or sell the product. On KuCoin Futures Pro, you can enter the order price and quantity and click “Buy/Long” or “Sell/Short” to place a limit order;

2. Market Order: A market order is an order to buy or sell the product at the best available price in the current market. On KuCoin Futures Pro, you can enter the order quantity and click “Buy/Long” or “Sell/Short” to place a market order;

3. Stop Order: A stop order is an order which will be triggered when the given price reaches the pre-specified stop price. On KuCoin Futures Pro, you can select trigger type and set stop price, order price and order quantity to place a stop order.

KuCoin Futures Pro supports the switch of order quantity unit between “Lot” and “BTC”. After switching, the display of the quantity unit in the trading interface will change as well.

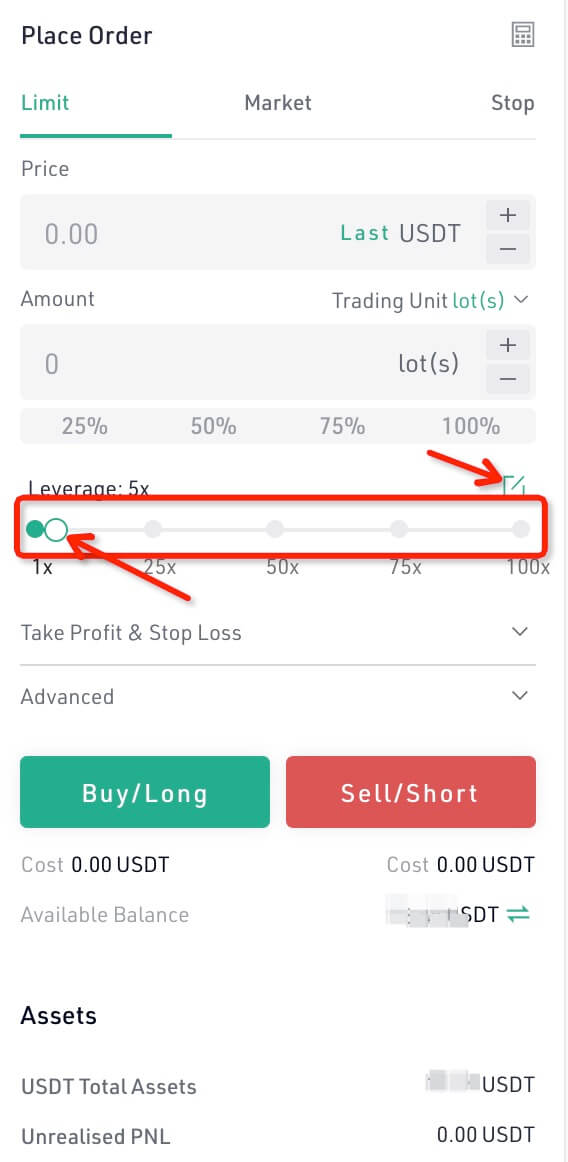

2) Leverage

The leverage is utilized to multiply your earnings. The higher the leverage is, the greater the earnings you will have and so does the losses you will have to bear, so please be prudent of your choices.

If your KuCoin Futures account is not KYC verified, your order leverage will be restricted. For accounts passed KYC verification, the leverage will be unlocked to the maximum.

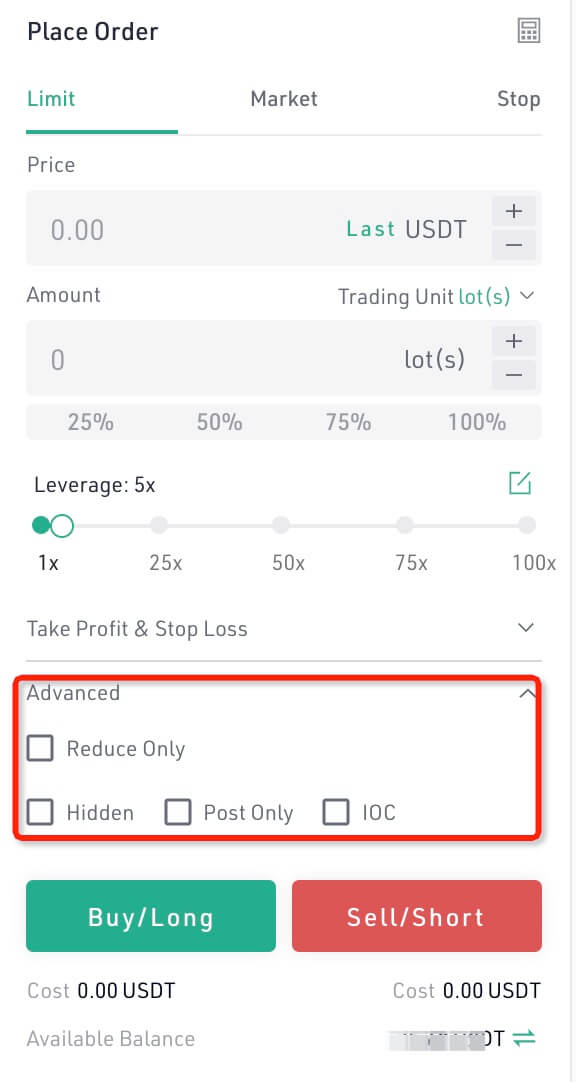

3) Advanced Settings

KuCoin Futures offers advanced settings including “Post Only”, “Hidden” and Time in Force policies such as GTC, IOC, etc. for orders. Please note that the advanced settings are only available for limit or stop orders.

4) Buy/Long Sell/Short

On KuCoin Futures Pro, if you’ve already entered the order info., you can click “Buy/Long” to go long your positions, or click “Sell/Short” to go short your positions.

1. If you went long your positions and the Futures price goes up, you will earn profit

2. If you went short your positions and the Futures price goes down, you will earn profit

*Notice (will be displayed below the “Buy/Long” and “Sell/Short” buttons):

The platform has maximum and minimum order price restrictions for orders;

The “Cost” is the needed margin to execute an order and please ensure there’s sufficient balance in your account to place an order.

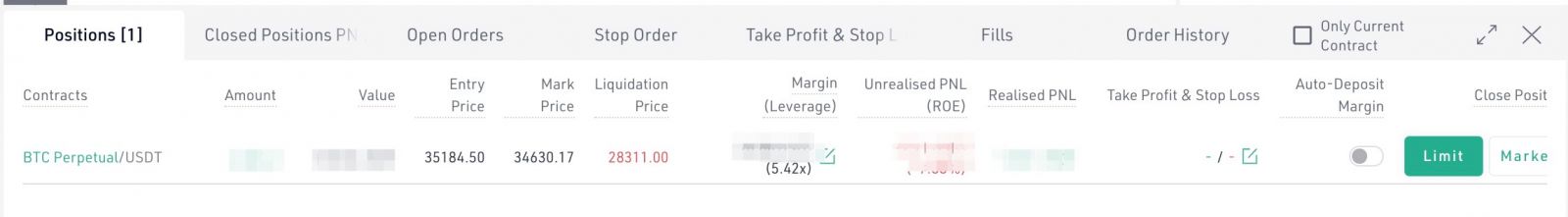

6. Holdings

On KuCoin Futures Pro, if you have submitted an order successfully, you can check or cancel your open and stop orders in the position list.

If your order is executed, you can check your position details in the “Open Positions”.

Quantity: Number of Futures in an order;

Entry Price: Average entry price of your current position;

Liquidation Price: If the price of the Futures is worse than the liquidation price, your position will be liquidated;

Unrealised PNL: The floating profit and loss of the current positions. If positive, you have profited; If negative, you have lossed funds. The percentage indicates the proportion of the profit and loss to the order amount.

Realised PNL: The calculation of the realised Pnl is based on the difference between the entry price and exit price of a position. Trading fees as well as Funding Fees are also included in the realised Pnl.

Margin: The minimum amount of funds you must hold to keep a position open. Once the margin balance drops below the maintenance margin, your position will be taken over by the Liquidation Engine and get liquidated.

Auto-Deposit Margin: When Auto-Deposit Margin mode is enabled, funds in the Available Balance will be added to the existing positions whenever liquidation happens, trying to prevent the position from being liquidated.

Take Profit/Stop Loss: Enabling take profit or stop loss settings and the system will perform the take profit and stop loss operations automatically to your positions to prevent funds losses caused by violate price fluctuation. (Recommend)

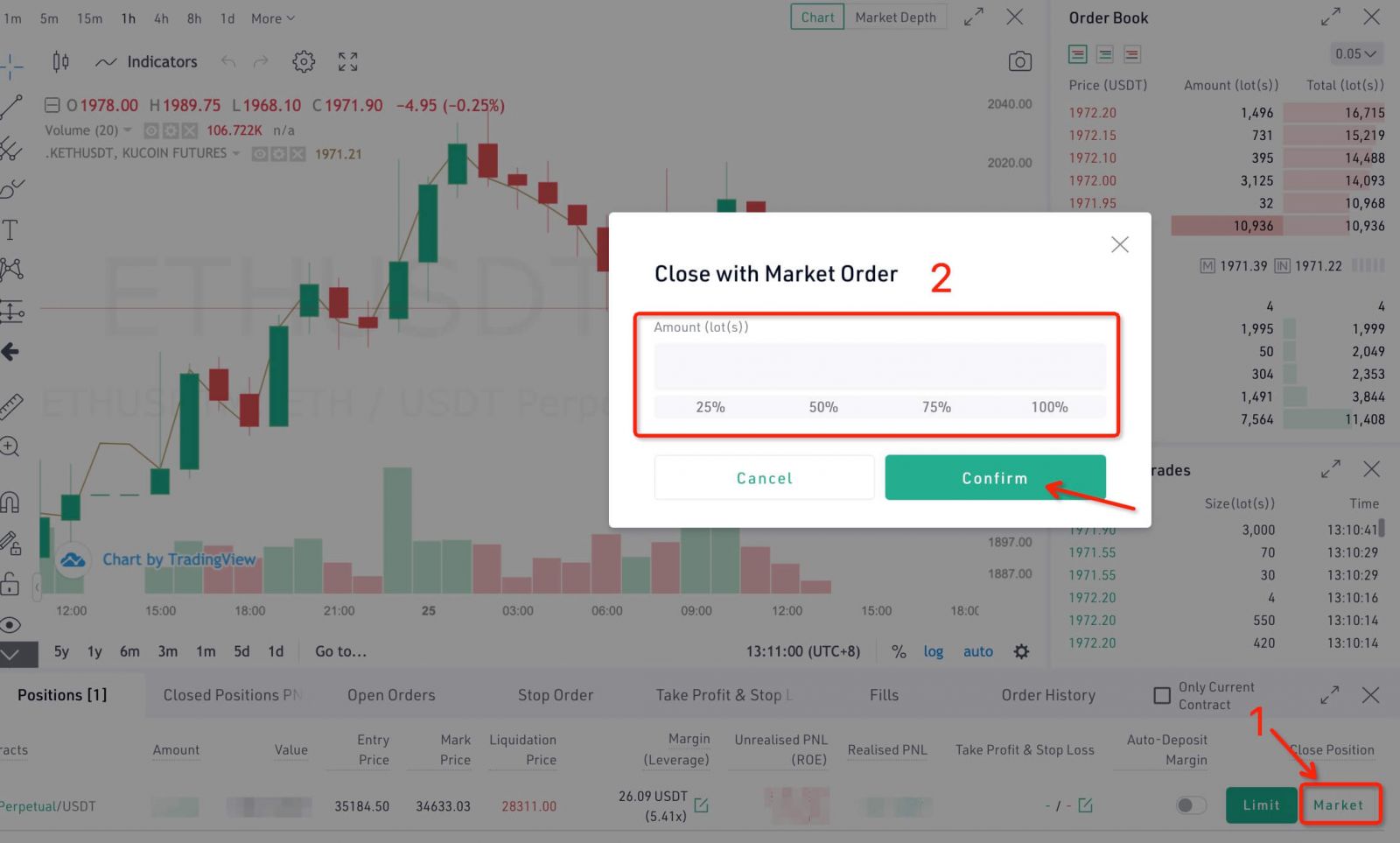

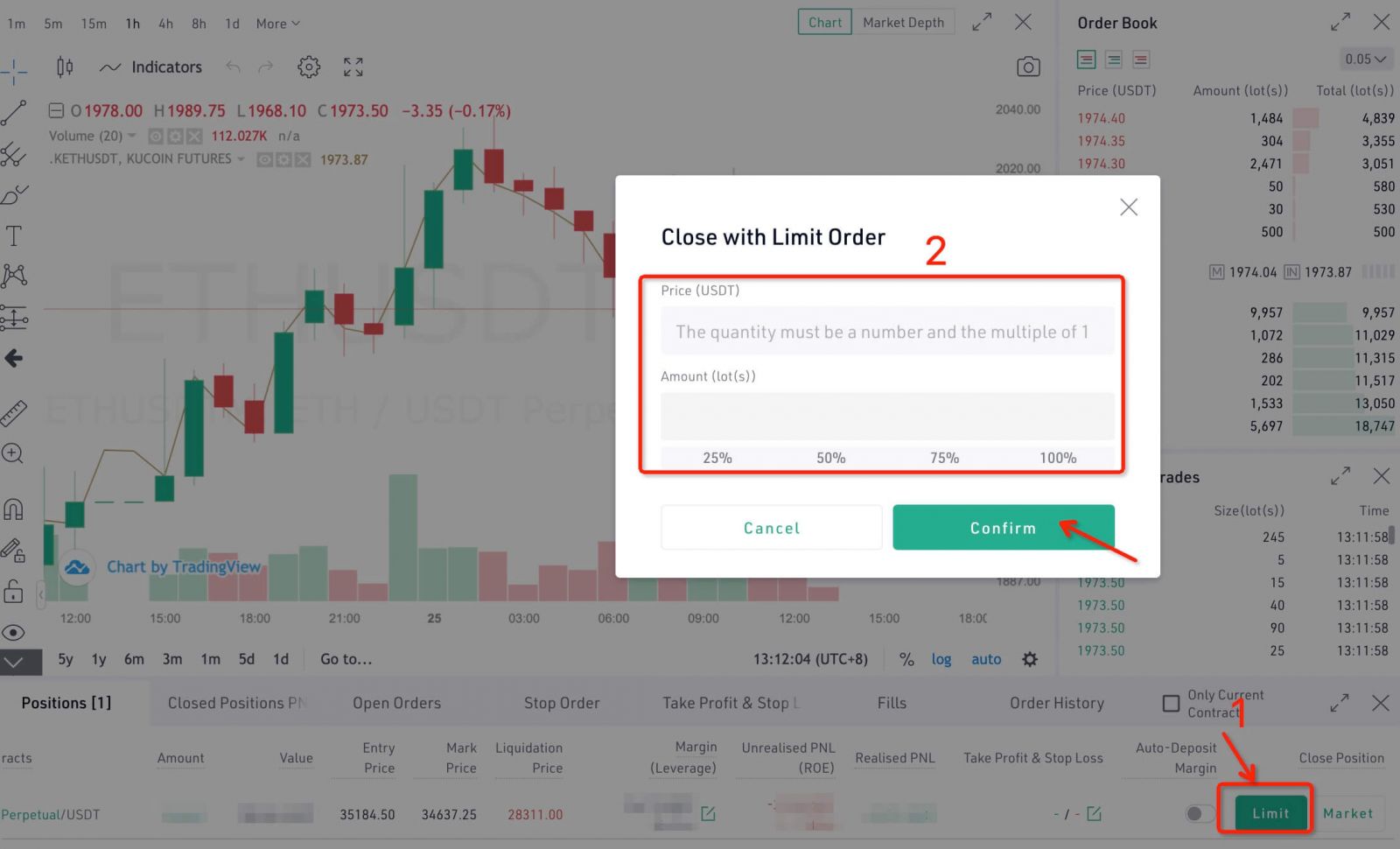

7. Close Positions

The KuCoin Futures position is designed an accumulated position. To close positions, you can click “Close” directly in the position area or you can go short to close your positions by placing an order.

* For example, if your current position size is +1,000 and you plan to close all positions, which means by the time your position size will become 0;

To fully close all positions, you can place an order to go short 400 positions, by the time the current position size will become +600; place another order to got short 600 positions, and the current position size will become 0.

Or you may also trade like this:

Place an order to go short 1400 positions and by the time, your position size will become -400.

You can close your positions with market or limit orders in the position list.

1)Close with Market Order: Enter the position size you plan to close, click “Confirm” and your positions will be closed at the current market price.

2)Close with Limit Order: Enter the position price and position size your plan to close and click “Confirm” to close your positions.

Notice:

- KYC users in restricted countries and regions cannot open Futures trading;

- Users with IP addresses in restricted countries and regions cannot open Futures trading;

- Users in our blacklist cannot open Futures trading.

Frequently Asked Questions (FAQ)

What is Maker and Taker?

KuCoin uses a taker - maker fee model for determining its trading fees. Orders that provide liquidity ("maker orders") are charged different fees than orders that take liquidity ("taker orders").When you place an order and it is executed immediately, you are considered as a Taker and will pay a taker fee. When you place an order which is not immediately matched to enter a buy or sell order, and you are considered as a Maker and will pay a maker fee.

The user as a maker may pay a lower fee as long as to reach level 2 than takers. Please check the screenshot below for more details.

When you place an order that gets partially matched immediately, you pay a Taker fee for that portion. The remainder of the order is placed to enter a buy or sell order and, when matched, it is considered as a Maker order, and the Maker fee will then be charged.

Differences Between Isolated Margin and Cross Margin

1. Margin in Isolated Margin mode is independent for each trading pair- Each trading pair has an independent Isolated Margin Account. Only specific cryptocurrencies can be transferred in, held and borrowed in a specific Isolated Margin Account. For instance, in the BTC/USDT Isolated Margin Account, only BTC and USDT are accessible.

- Margin level is calculated solely in each Isolated Margin Account based on the asset and debt in the isolated. When the positions of the isolated margin account need to be adjusted, you can only operate in each trading pair independently.

- Risk is isolated in each Isolated Margin Account. Once liquidation happens, it will not affect other isolated positions.

2. Margin in cross margin mode is shared among the user’s Margin Account

- Each user can only open one cross margin account, and all trading pairs are available in this account. Assets in cross margin account are shared by all positions;

- Margin level is calculated according to total asset value and debt in the Cross Margin Account.

- The system will check the margin level of the Cross Margin Account and notify users about supplying additional margin or closing positions. Once liquidation happens, all positions will be liquidated.

What is the fee structure in KuCoin Futures?

At KuCoin Futures, if you provide liquidity to the books, then you are a ‘Maker’ and will be charged at 0.020%. However, if you take liquidity, then you are a ‘Taker’ and will be charged 0.060% on your trades.How to get free bonuses from KuCoin Futures?

KuCoin Futures is offering bonus for newbies!Enable Futures trading now to claim the bonus! Futures trading is a 100x magnifier of your profits! Try now to leverage more profits with less funds!

🎁 Bonus 1: KuCoin Futures will airdrop bonus to all users! Enable futures trading now to claim up to 20 USDT of bonus for newbies only! Bonus can be used in Futures trading and profits generated from it can be transferred or withdrawn! For more details, please check KuCoin Futures Trial Fund.

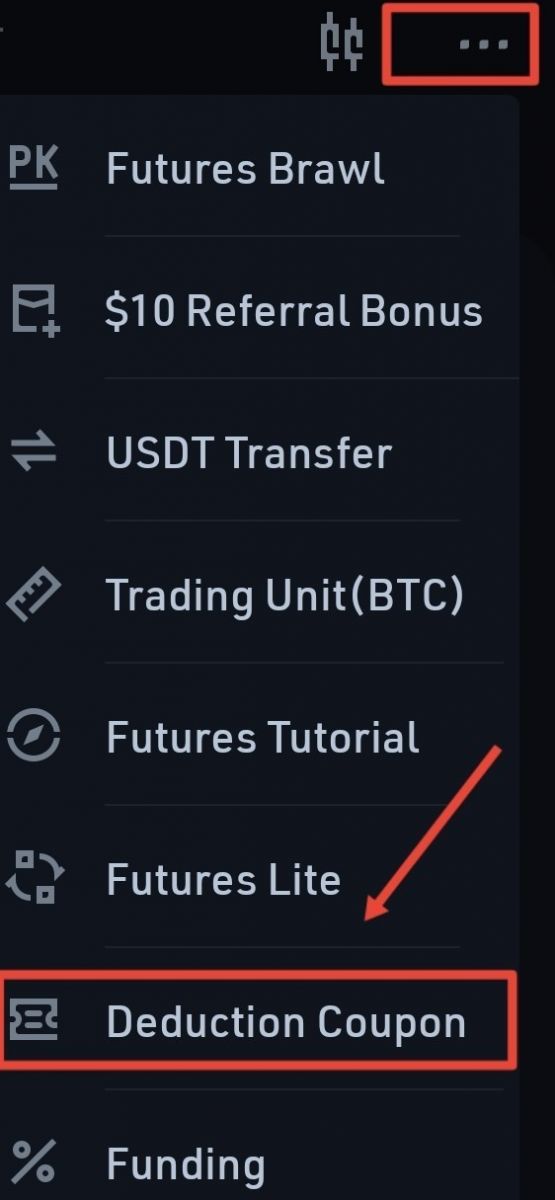

🎁 Bonus 2: Futures deduction coupon has been distributed to your account! Go claim it now! The deduction coupon can be used to deduct Futures trading fees of random amount.

*How to Claim?

Tap into “Futures”--- “Deduction Coupon” in KuCoin app