About KuCoin

- Low trading and withdrawal fees

- User-friendly exchange

- Vast selection of altcoins

- 24/7 customer support

- Ability to buy crypto with fiat

- No forced KYC checks

- Ability to stake and earn crypto yields

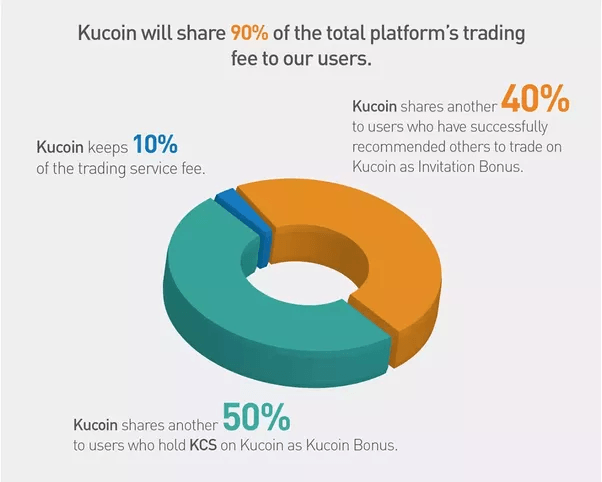

It offers bank-level security, slick interface, beginner-friendly UX, and a wide range of crypto services: margin and futures trading, a built-in P2P exchange, ability to buy crypto using a credit or debit card, instant-exchange services, ability to earn crypto by lending or staking via its Pool-X, opportunity to participate in fresh initial exchange offerings (IEOs) via KuCoin Spotlight, some of the lowest fees in the market, and much more! Investors like KuCoin due to its tendency to list small-cap cryptocurrencies with tremendous upside potential, a large selection of coins, lesser-known cryptos, and generous profit-sharing incentives - up to 90% of trading fees go back to the KuCoin community through its KuCoin Shares (KCS) tokens.

General info

- Web address: KuCoin

- Support contact: Link

- Main location: Seychelles

- Daily volume: 15188 BTC

- Mobile app available: Yes

- Is decentralized: No

- Parent Company: Mek Global Limited

- Transfer types: Credit Card, Debit Card, Crypto Transfer

- Supported fiat: USD, EUR, GBP, AUD +

- Supported pairs: 456

- Has token: KCS

- Fees: Very Low

Pros

- Low trading and withdrawal fees

- User-friendly exchange

- Vast selection of altcoins

- 24/7 customer support

- Ability to buy crypto with fiat

- No forced KYC checks

- Ability to stake and earn crypto yields

Cons

- No fiat trading pairs

- No bank deposits

- May appear complicated for newbies

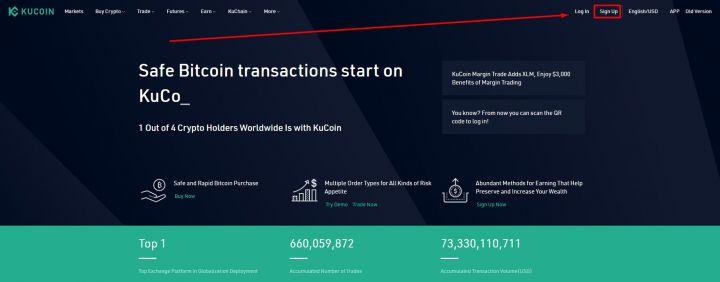

Screenshots

KuCoin Review: Key features

KuCoin has grown into a top cryptocurrency exchange that can boast of serving every one out of four crypto holders worldwide. It has developed an impressive suite of crypto services, including the fiat onramp, futures and margin trading exchange, passive income services such as staking and lending, peer-to-peer (P2P) marketplace, IEO launchpad for crypto crowdfunding, non-custodial trading, and much more.

Other notable KuCoin features include:

- Buy and sell 200 cryptocurrencies with low fees worldwide. As one of the top cryptocurrency exchanges, KuCoin supports a wide variety of crypto assets. In addition to the bonuses and discounts, it charges a 0.1% fee per trade and even small fees for futures trading.

- Buy crypto with top fiat currencies, including USD, EUR, CNY, GBP, CAD, AUD, and many more. KuCoin lets you buy cryptocurrencies with fiat using its P2P fiat trade, credit or debit card via Simplex, Banxa, or PayMIR, or its Fast Buy service, which facilitates IDR, VND, and CNY purchases of Bitcoin (BTC) or Tether (USDT).

- Excellent customer support service that can be contacted 24/7 via its website, email, ticketing system, and other channels.

- Bank-level asset security. KuCoin uses many security measures, including micro-withdrawal wallets, industry-level multilayer encryption, dynamic multifactor authentication, and dedicated internal risk control departments which oversee day-to-day data operations according to strict security standards.

- KuCoin Futures and Margin Trading. Long or short your favorite cryptocurrencies with up to 100x leverage!

- Earn cryptocurrency. Check out KuCoin’s crypto lending, staking, soft staking, and KuCoin Shares (KCS) bonus on how you can put your cryptocurrencies at work to generate yield.

- Intuitive and beginner-friendly platform. Excellent design and the robust trading platform make trading easy and enjoyable for everyone.

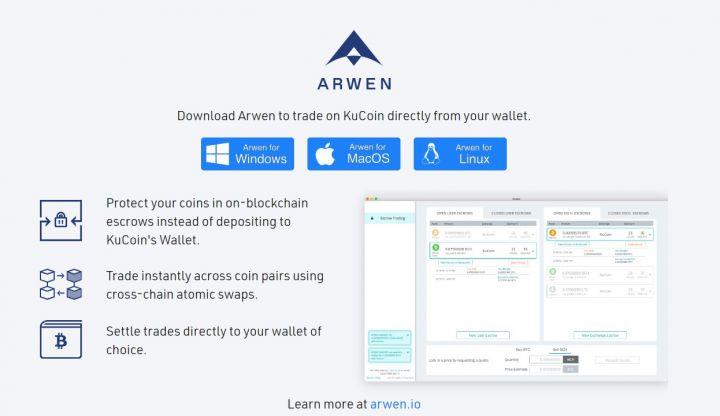

- Non-custodial trading. In case you’re interested in ramping up your crypto security, KuCoin supports an ability for non-custodial trading directly from your private wallet, which is facilitated by Arwen.

In brief, KuCoin is an excellent cryptocurrency exchange for cryptocurrency investors. It can boast of relatively high liquidity, a high number of users, a wide selection of supported assets and services, as well as low trading fees. Additionally, it does not force KYC checks on all of its users, which remains a valuable perk for privacy-conscious individuals.

KuCoin History And Background

Although the exchange started operating in mid-2017, its founding team has been experimenting with blockchain technology since 2011. The platforms technical architecture was created in 2013, yet it took years of polishing to make it a seamless experience KuCoin is today.

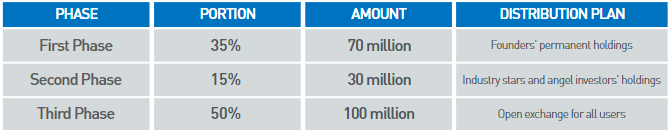

Funds for KuCoin development were raised via an ICO, which lasted from August 13, 2017, to September 1, 2017. During that time, KuCoin issued its native KuCoin Shares (KCS) tokens, which are used to receive special offers, trading discounts, and a part of exchange profits. The crowdsale was a success, as KuCoin raised nearly USD 20,000,000 in BTC (at the time) for 100,000,000 KCS. The ICO price for a single KCS was 0.000055 BTC.

Today, the companys headquarters are in Seychelles. The company is said to employ over 300 employees worldwide.

2019 was a year of significant upgrades for the KuCoin platform. In February, the exchange has upgraded its interface to Platform 2.0, which gave the platform a facelift it uses today. The upgrade also included more features such as advanced order types, new API, and other functions.

In June, KuCoin has also launched KuMEX, which has now been rebranded to KuCoin Futures. Later in the year, the exchange also introduced its margin trading with up to 10x leverage.

KuCoin continues to grow its ecosystem in 2020. Amongst more important announcements was the launch of its Pool-X Liquidity Trading Market, as well as a one-stop exchange solution KuCloud. In February, the exchange also launched its instant exchange service. Besides, KuCoin has substantially increased the number of supported fiat currencies for crypto purchases via its “Buy Crypto” with a bank card option. On June 24, 2020, KuCoin announced that its P2P crypto marketplace supports sales and purchases via PayPal, as well as more convenient fiat payment methods.

As of today, KuCoin provides services in most countries in the world, including Turkey, India, Japan, Canada, United Kingdom, Singapore, and many others.

The trading website is translated into 17 languages, including English, Russian, South Korean, Dutch, Portuguese, Chinese (simplified and traditional), German, French, Spanish, Vietnamese, Turkish, Italian, Malay, Indonesian, Hindi, and Thai.

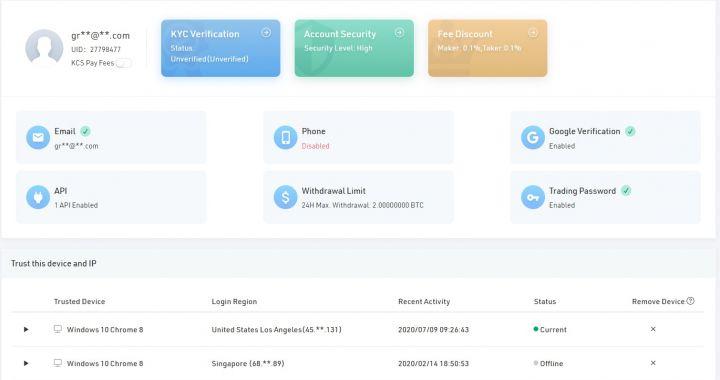

KuCoin account verification

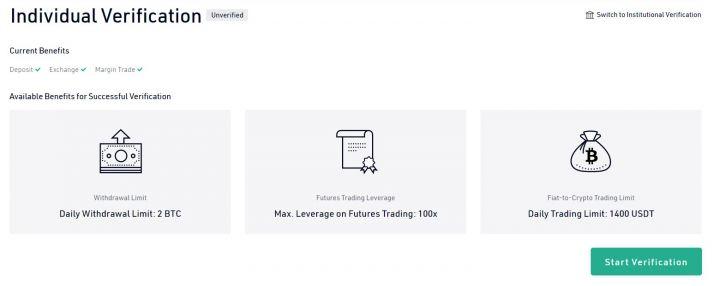

On November 1, 2018, KuCoin implemented know your customer (KYC) verification to combat facilitate combat against criminals and money laundering schemes. Nevertheless, account verification at KuCoin is entirely optional, especially if you’re a small volume trader. It means that you do not have to verify your identity to trade, however, verified users get benefits such as increased daily withdrawal limits or simplified account recovery in case of a lost password or two-factor authentication device.

At pixel time, KuCoin has three verification levels:

- Unverified account. It requires email verification, lets you withdraw up to 2 BTC per 24 hours.

- Verified Individual account. Requires you to submit your identity details such as ID or passport, as well as your country of residence, and increases your withdrawal limit to 100 BTC per 24 hours.

- Verified institutional account. Increases your withdrawal limit to 500 BTC per 24 hours.

According to KuCoin, users are strongly recommended to complete verification to avoid troubles in the future. Besides, verified users will be able to participate in fiat-to-crypto trading once it becomes available on the platform.

In June 2020, KuCoin announced its partnership with crypto on-chain analytics and surveillance company Chainalysis in order to increase its compliance efforts further.

KuCoin Fees Overview

KuCoin offers some of the lowest fees among altcoin exchanges. Its fee structure is relatively straightforward and easy to understand.

First and foremost is KuCoin spot trading fees. Here, every deal is subject to the fixed 0.1% fee. The costs tend to decrease based on your 30-day trading volume or KuCoin Shares (KCS) holdings, which entitle you to the additional trading fee discount. Besides, you case use KCS tokens to cover some of your trading fees with KCS Pay.

| Tier | Min. KCS holding (30 days) | 30-day trade volume in BTC | Maker/Taker fee | KCS Pay fees |

|---|---|---|---|---|

| LV 0 | 0 | 0.1%/0.1% | 0.08%/0.08% | |

| LV 1 | 1,000 | ≥50 | 0.09%/0.1% | 0.072%/0.08% |

| LV 2 | 10,000 | ≥200 | 0.07%/0.09% | 0.056%/0.072% |

| LV 3 | 20,000 | ≥500 | 0.05%/0.08% | 0.04%/0.064% |

| LV 4 | 30,000 | ≥1,000 | 0.03%/0.07% | 0.024%/0.056% |

| LV 5 | 40,000 | ≥2,000 | 0%/0.07% | 0%/0.056% |

| LV 6 | 50,000 | ≥4,000 | 0%/0.06% | 0%/0.048% |

| LV 7 | 60,000 | ≥8,000 | 0%/0.05% | 0%/0.04% |

| LV 8 | 70,000 | ≥15,000 | -0.005%/0.045% | -0.005%/0.036% |

| LV 9 | 80,000 | ≥25,000 | -0.005%/0.04% | -0.005%/0.032% |

| LV 10 | 90,000 | ≥40,000 | -0.005%/0.035% | -0.005%/0.028% |

| LV 11 | 100,000 | ≥60,000 | -0.005%/0.03% | -0.005%/0.024% |

| LV 12 | 150,000 | ≥80,000 | -0.005%/0.025% | -0.005%/0.02% |

Besides, the exchange has an institutional investor program whose participants can get significant trading fee discounts.

Here is how KuCoin fees compare with other popular altcoin exchanges:

| Exchange | Altcoin pairs | Trade fees |

|---|---|---|

| Kucoin | 400 | 0.1% |

| Binance | 539 | 0.1% |

| HitBTC | 773 | 0.07% |

| Bittrex | 379 | 0.2% |

| Poloniex | 92 | 0.125%/0.0937% |

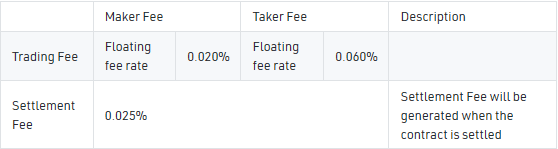

When it comes to Futures trading, KuCoin uses the following fee structure:

The KuCoin Futures trading fees also come with floating 30-day trading volume or KuCoin Shares holdings based tier discount system.

| Tier | Min. KCS holding (30 days) | 30-day trade volume in BTC | Maker/Taker fee |

|---|---|---|---|

| LV 0 | 0 | 0.02%/0.06% | |

| LV 1 | 1,000 | ≥100 | 0.015%/0.06% |

| LV 2 | 10,000 | ≥400 | 0.01%/0.06% |

| LV 3 | 20,000 | ≥1,000 | 0.01%/0.05% |

| LV 4 | 30,000 | ≥2,000 | 0.01%/0.04% |

| LV 5 | 40,000 | ≥3,000 | 0%/0.04% |

| LV 6 | 50,000 | ≥6,000 | 0%/0.038% |

| LV 7 | 60,000 | ≥12,000 | 0%/0.035% |

| LV 8 | 70,000 | ≥20,000 | -0.003%/0.032% |

| LV 9 | 80,000 | ≥40,000 | -0.006%/0.03% |

| LV 10 | 90,000 | ≥80,000 | -0.009%/0.03% |

| LV 11 | 100,000 | ≥120,000 | -0.012%/0.03% |

| LV 12 | 150,000 | ≥160,000 | -0.015%/0.03% |

When it comes to futures funding fees, KuCoin Futures has adjustable The USD/USDT lending rate, as they adjust for the relative funding rates and can be either positive or negative. With this adjustment, the lending rate gap between the base currency and quote currency of the perpetual futures funding rate will shift from 0.030% to 0%, which means the funding fee of the perpetual futures of KuCoin will become 0 during normal periods. KuCoin Futures funding occurs every 8 hours at 04:00, 12:00, and 20:00 UTC.

Last but not least, there are deposit and withdrawal transactions. The deposits are free, while withdrawals incur a small cost, which differs per cryptocurrency. NEO and GAS are free to withdraw from KuCoin.

| Coin/WithdrawalFee | KuCoin | Binance | HitBTC |

|---|---|---|---|

| Bitcoin (BTC) | 0.0004 BTC | 0.0004 BTC | 0.0015 BTC |

| Ethereum (ETH) | 0.004 ETH | 0.003 ETH | 0.0428 ETH |

| Litecoin (LTC) | 0.001 LTC | 0.001 LTC | 0.053 LTC |

| Dash (DASH) | 0.002 DASH | 0.002 DASH | 0.00781 DASH |

| Ripple (XRP) | 0.1 XRP | 0.25 XRP | 6.38 XRP |

| EOS (EOS) | 0.1 EOS | 0.1 EOS | 0.01 EOS |

| Tron (TRX) | 1 TRX | 1 TRX | 150.5 TRX |

| Tether (USDT) (OMNI) | 4.99 USDT | 4.56 USDT | 20 USDT |

| Tether (USDT) (ERC20) | 0.99 USDT | 1.12 USDT | - USDT |

| Tether (USDT) (TRC20/EOS) | 0.99 USDT | Free/- USDT | -/- USDT |

| NEO (NEO) | Free | Free | 1 NEO |

In most cases, KuCoin withdrawal fees match up with Binance’s, which is known to be the lowest fee exchange. For a complete KuCoin withdrawal fee for each cryptocurrency, visit its fee structure page.

Finally, you might want to buy cryptocurrencies with fiat via KuCoin. The exchange supports several ways to do so, including direct bank card purchase via Simplex, Banxa, or PayMIR integrations, P2P desk, and fast buy feature. The fees on those transactions may vary according to the chosen payment method, but should not exceed 5 - 7% on any given day. For example, Simplex typically charges 3.5% per purchase, while Baxa is said to charge 4 - 6% on top of the total transaction amount. For P2P marketplace purchases, the fees depend entirely on the chosen payment method and processor rates, so keep in mind when accepting or posting an advertisement.

Overall, KuCoin is one of the lowest-fee exchanges in terms of trading fees. It is safe to say that KuCoin’s biggest competitor is Binance, as both exchanges have similar competitive strategies. They charge almost equally low fees, though KuCoin Shares (KCS) offer some additional advantages.

What Are The KuCoin Shares (KCS)?

As mentioned above, KuCoin Shares (KCS) were used to fund the creation of the exchange. In total, 200,000,000 KCS were issued and distributed to founders, private investors, and regular investors. Funds issued in the first and second phases are subjects to four (September 2, 2021, for phase one) and two year lock-up periods (September 2, 2019, for phase two).

KCS holders enjoy the following benefits:

- Receive daily cryptocurrency dividends, which account for 50% of the collected trading fees.

- Get a trading fee discount (min. 1000 KCS for 1% discount; max 30,000 KCS for 30% discount). The system takes a snapshot of users KCS holdings daily at 00:00 (UTC +8) to calculate the applicable discount rate.

- More trading pairs, including BTC, ETH, LTC, USDT, XRP, NEO, EOS, CS, GO.

- Experience exclusive KCS holder perks and offers.

KuCoin users earn part of the daily exchange profits by staking KCS. For instance, if you hold 10,000 KCS, and the exchange collects 20 BTC in trading fees (0.1% of daily trading volume), you would receive 0.001 BTC converted to KCS per day (20 * 50% * (10000/100000000)).

Another way to earn KCS is by referring your friends. You can make up to 20% referral bonus each time your friend completes an order. You can sign up on the exchange using our KuCoin referral code: 2N1dNeQ.

In total, as much as 90% of KuCoin trading fees get back to the community:

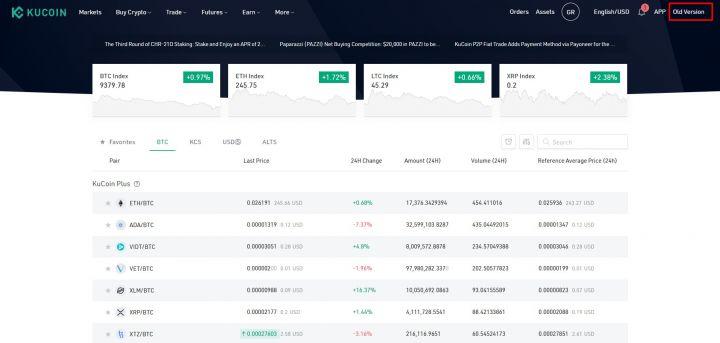

KuCoin Design and Usability

KuCoin is straightforward and easy to use even for beginners. It has a modern and straightforward layout that extends through all pages and is powered by a powerful API interface. The trading platform uses an advanced core trading engine that can handle millions of transactions per second (TPS).

Besides, you can switch between the old and new exchange interfaces. Both of them are convenient in their own way, so it is up to you to decide whether you prefer the old or new exchange layout.

The most important feature of any exchange is spot trading. Here, KuCoin allows you to exchange over 200 tokens and cryptocurrencies with reasonably low fees - every trade will cost you 0.1% as a taker or maker.

If you want to make a trade, you need to go to the “Markets” tab and search for the market you want to trade. Entering the trading window requires you to submit a trading password, which you can set up as an extra security measure. Although it may look complicated at first, the exchange has a clean and straightforward layout.

Here you have the following windows:

- Price chart with advanced charting tools for technical analysis (TA) by TradingView.

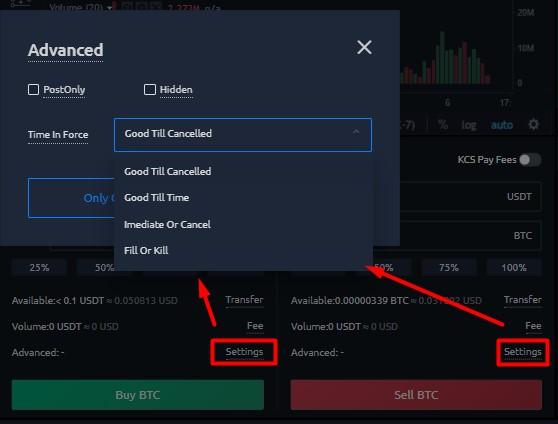

-

Order placing window for buying (green) and selling (red). At the moment, KuCoin supports Limit, Market, Stop Limit, and Stop Market orders. Also, you can specify extra order characteristics such as Post-Only, Hidden, or Time In Force (Good Till Cancelled, Good Till Time, Immediate Or Cancel, and Fill or Kill) according to your trading tools and strategy.

- Markets window, which helps you to switch between different trading pairs in seconds. Markets with 10x mark are also available in KuCoin’s margin trading.

- Order book with all current buy and sell orders.

- Recent trades window where you can choose to see the most recent trades in the market or market’s depth.

- Your open orders, stop orders, order history, and trading history.

- News panel with the latest KuCoin and market news.

Though this trading interface may be confusing for newbies, experienced traders should find their way around the exchange rather quickly. On the other hand, new investors may find it somewhat confusing, as the simple trading interface with just a few options to either buy or sell crypto is lacking.

All in all, it is safe to say KuCoin is a powerful and beginner-friendly exchange. For users who prefer to trade on the go, KuCoin has a convenient mobile app available on both Android and iOS mobile devices.

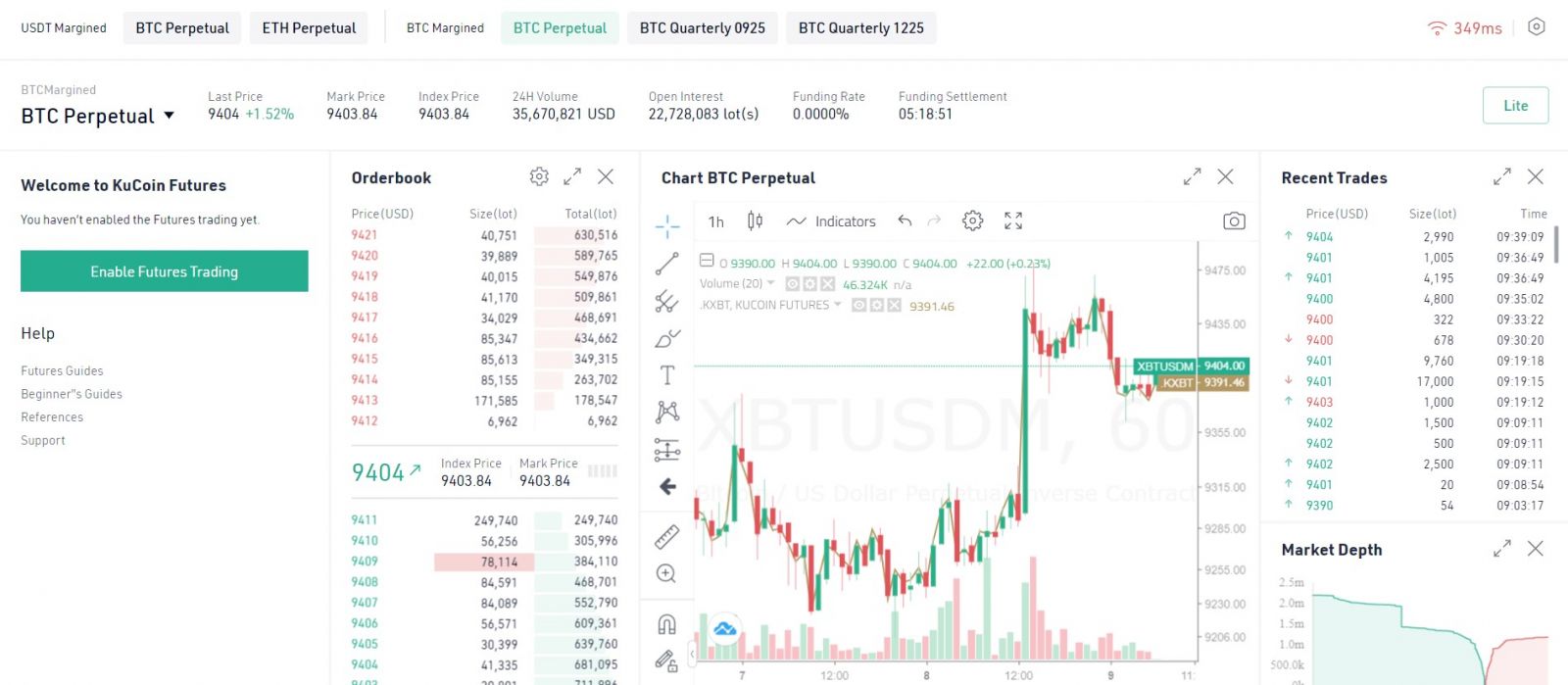

KuCoin Futures trading for both beginners and pro users

KuCoin launched its Futures (previously known as KuMEX) platform in mid-2019. It allows users to trade Bitcoin (BTC) and Tether (USDT) margined contracts with up to 100x leverage. It means that you can trade up to USD 10,000 worth of contracts with just USD 100 in your account.

There are two versions of KuCoin Futures - one designated for beginners (lite version) and one oriented towards more experienced traders (pro version).

The Lite interface lets you trade USDT-Margined Bitcoin (BTC) and Ethereum (ETH) contracts, as well as BTC-margined BTC futures contracts.

The Pro interface is more advanced and lets you switch between the following contracts:

- USDT-margined: BTC perpetual, ETH perpetual

- BTC-margined: BTC perpetual, BTC Quarterly 0925, and BTC Quarterly 1225

KuCoin Futures calculates the underlying spot price using the weighted price average from other exchanges like Kraken, Coinbase Pro, and Bitstamp.

If you’re interested to learn more about KuCoin Futures, check out these beginner and perpetual contract guides.

Margin trading with up to 10x leverage

Another cool feature of KuCoin is their margin trading, which currently allows you to long or short 36 USDT, BTC, and ETH denominated market pairs with up to 10x leverage. The pairs include top cryptocurrencies like Bitcoin, Ethereum, Litecoin, XRP, EOS, ATOM, Dash, Tron, Tezos, Cardano, and others.

Unlike KuCoin Futures, margin trading occurs directly on the spot exchange, where you can select margin trading markets and place margin trading orders on the exchange.

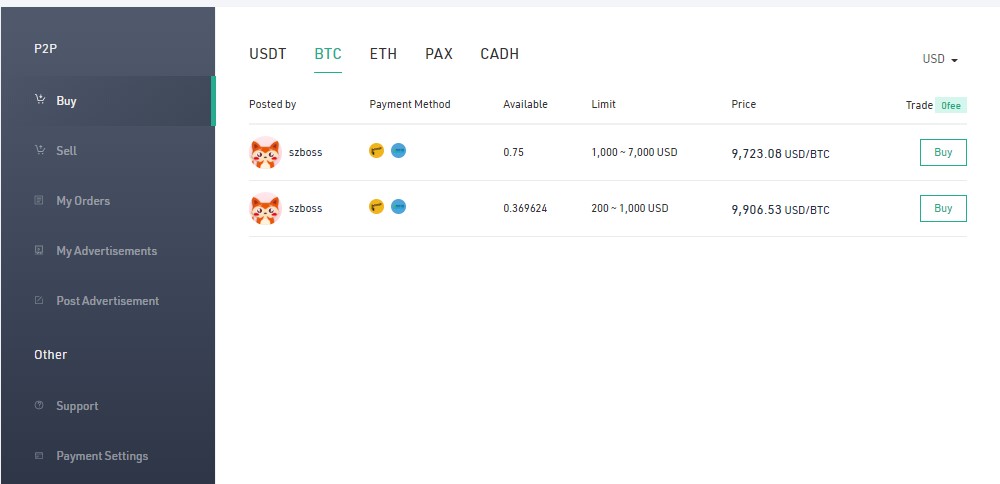

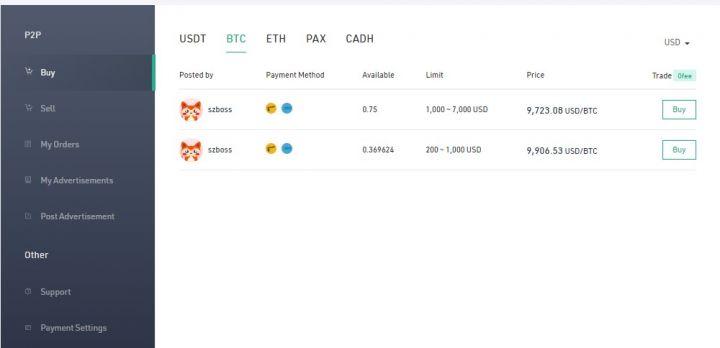

P2P fiat trade

KuCoin P2P marketplace is another convenient service provided by KuCoin. Here, you can buy and sell cryptocurrencies like USDT, BTC, ETH, PAX, and CADH directly to and from other merchants.

The P2P marketplace supports various payment methods, including PayPal, Wire transfers, Interact, and other popular payment methods using most popular fiat currencies like USD, CNY, IDR, VND, and CAD.

In order to trade using KuCoin P2P desk, you must verify your KuCoin account.

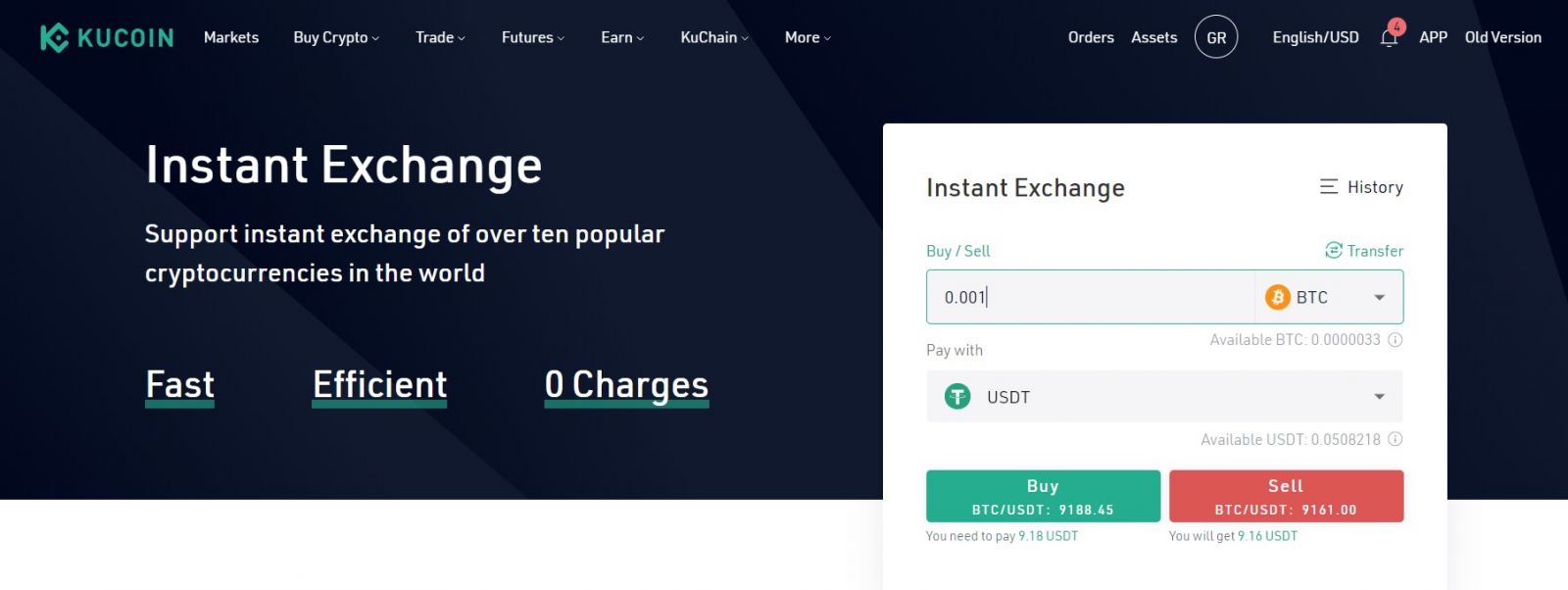

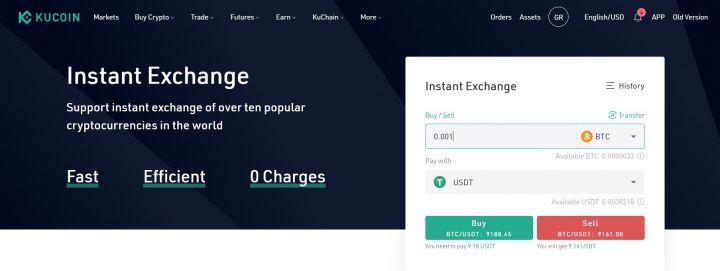

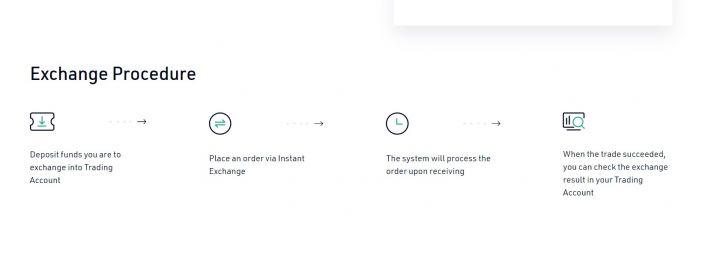

KuCoin instant-exchange

Established in partnership with HFT, KuCoin instant exchange facilitates instant crypto-to-crypto exchanges.

Currently, KuCoin’s instant exchange lets you swap Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and XRP (XRP) for Tether (USDT) and Bitcoin (BTC).

The exchange service looks for the best exchange rates and is currently free of charge.

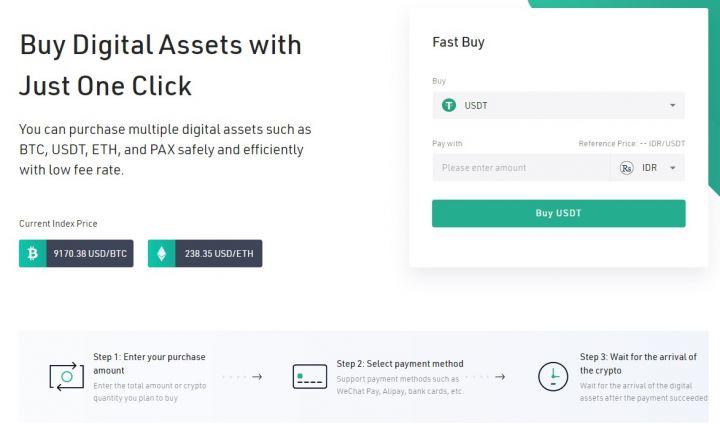

Fast buy feature

KuCoin Fast Buy feature allows traders to buy and sell BTC, USDT, and other cryptocurrencies using IDR, VND, and CNY fiat currencies. It’s great for quick and low fee crypto purchases using payment methods like WeChat, Alipay, bank cards, and other fiat payment methods.

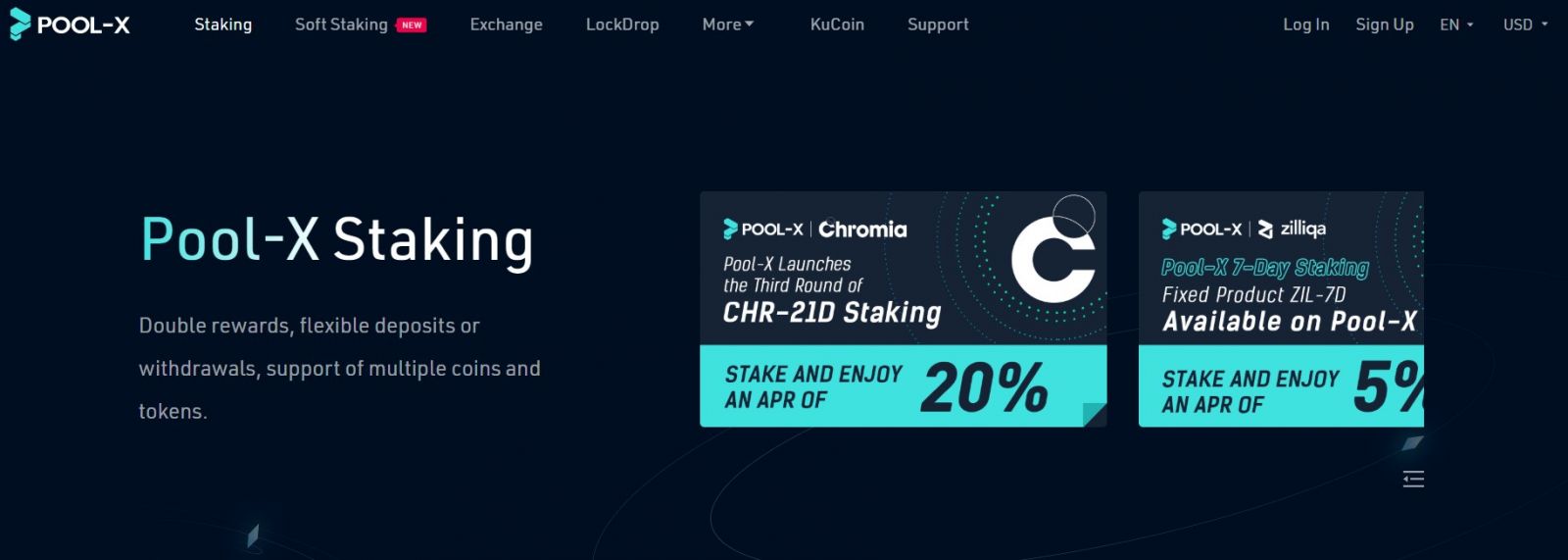

KuCoin Earn

KuCoin also offers its users an ability to employ their digital assets in a variety of staking and lending programs. These include:

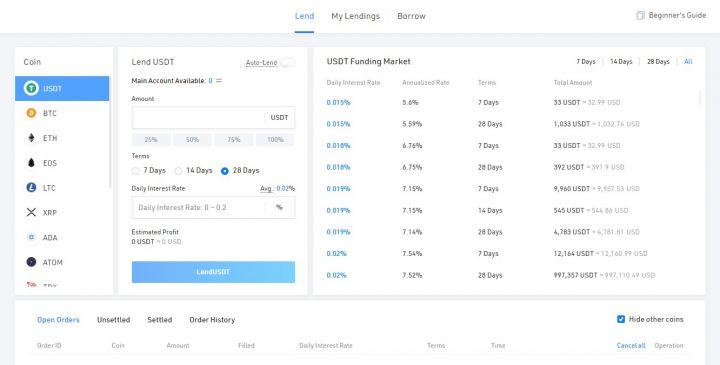

- KuCoin Lend. Earn interest on your digital assets by lending them out for the funding of margin accounts. The loans last for either 7, 14, or 28 days, and you can earn up to 12% annualized interest rate from your holdings. At the moment, the lending service accepts USDT, BTC, ETH, EOS, LTC, XRP, ADA, ATOM, TRX, BCH, BSV, ETC, XTZ, DASH, ZEC, and XLM cryptocurrencies.

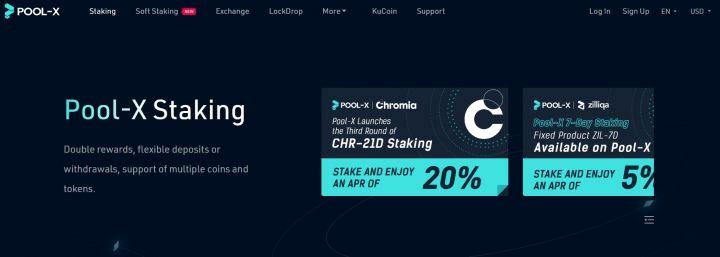

- Pool-X. Pool-X is a next-generation proof-of-stake (PoS) mining pool - an exchange designed to deliver liquidity services for staked tokens. It lets you earn high yield for PoS cryptocurrencies like EOS, TOMO, ZIL, ATOM, KCS, XTZ, ZRX, IOST, TRX, and many others. Pool-X is fueled by Proof of Liquidity (POL), a decentralized zero-reservation credit issued on TRON’s TRC-20 protocol.

- Soft staking. As a part of Pool-X, soft staking lets you earn rewards for holding coins and tokens. You can get up to15% annual yield, with extremely low minimum deposits.

KuCoin Spotlight IEO platform

Aside from trading, staking, exchange, and swapping services, KuCoin also has its initial exchange offering (IEO) launchpad, aka KuCoin Spotlight.

Here, you can invest in new hot crypto projects vetted and supported by KuCoin. The launchpad has already funded 7 IEOs, namely, Tokoin, Lukso, Coti, Chromia, MultiVAC, Bitbns, and Trias.

To participate in KuCoin’s IEOs, you need to have a verified account. Most of the offerings use KuCoin Shares (KCS) as the main currency of the crowdsale.

Non-custodial trading with Arwen

KuCoin also lets its users trade on the exchange in a non-custodial manner, which is excellent for security-minded traders. To use this feature, you need to download and install the Arwen client, which is available for Windows, macOS, and Linux-powered devices.

KuCloud advanced technology solutions and ecosystem

As you may have noticed, KuCoin is an ever-growing crypto ecosystem with an increasing suite of services. Asides from the products mentioned above, KuCoin is also developing the following digital currency products:

- KuChain. An upcoming native blockchain developed by the KuCoin community.

- KuCloud. An advanced white-label technology solution for anyone interested in launching spot and derivative exchanges with adequate liquidity. It consists of two services - XCoin spot exchange and XMEX derivatives trading platform solution.

- Kratos. An official testnet for the upcoming KuChain.

- Ecosystem. A growing KuChain infrastructure powered by KCS and various KuCoin partners.

All in all, KuCoin is a leading cryptocurrency exchange that is easy to use with a number of services for both beginners and experienced investors. Aside from spot trading, it has numerous initiatives that showcase the exchange’s willingness to innovate and propel the adoption of crypto and blockchain technologies.

KuCoin Security

As of July 2020, there haven’t been any reported KuCoin hacking incidents. The exchange brings about a compelling mix of security precautions on both system and operational levels. System-wise, the exchange was constructed according to finance industry standards, which grant it bank-level data encryption and security. On the operational level, the exchange employs specialized risk control departments that enforce strict rules for data usage.

In April 2020, the exchange announced a strategic cooperation with Onchain Custodian, a Singapore-based crypto custody service provider, which is taking care of KuCoin’s crypto assets. Besides, the funds in custody are backed by Lockton, which is one of the largest private insurance brokers.

On a user side of things, you can maximize your KuCoin account security by setting up:

- Two-factor authentication.

- Security questions.

- Anti-phishing safety phrase.

- Login safety phrase.

- Trading password.

- Phone verification.

- Email notifications.

- Restrict login IP (recommended when keeping at least 0.1 BTC).

Using these settings, you can be sure that your funds are secure. However, a standard recommendation is that you don’t keep all of your funds in the exchange, as they introduce an extra point of failure. Instead, keep only what you can afford to lose on the exchanges.

Overall, most users agree that KuCoin is a safe and reliable platform.

KuCoin Customer support

KuCoin has a helpful around the clock customer support staff that is reachable via the following channels:

- KuCoin Help Center

- FAQ Center

- Onsite chat

- Mobile app support

Besides, you can reach out to other KuCoin users, as well as join the exchange’s community via the following social media channels:

- Facebook (available in English, Vietnamese, Russian, Spanish, Turkish, Italian).

- Telegram (available in English, Chinese, Vietnamese, Russian, Spanish, Turkish, Italian).

- Twitter (available in English, Vietnamese, Russian, Spanish, Turkish, Italian).

- Reddit (available in English, Vietnamese, Russian, Spanish, Turkish, Italian).

- YouTube

- Medium

Overall, its customer support is quick to respond and will help you with your queries within a few hours at most.

KuCoin Deposits and Withdrawals

KuCoin is an exclusively crypto-to-crypto exchange, which means you cannot deposit any fiat, except when you buy it directly via third-party integrations (like SImplex or Banxa). It supports neither fiat trading pairs nor deposits, but it supports increasingly more fiat payment methods that are integrated into its “Buy Crypto” services.

KuCoin does not charge fees for deposits and has a varying fixed fee for withdrawals. Transaction processing times usually depend on the asset’s blockchain, but they are executed within one hour, so withdrawals usually reach user wallets in 2-3 hours. More substantial withdrawals are processed manually, so users who withdraw higher amounts may have to wait 4-8 hours at times.

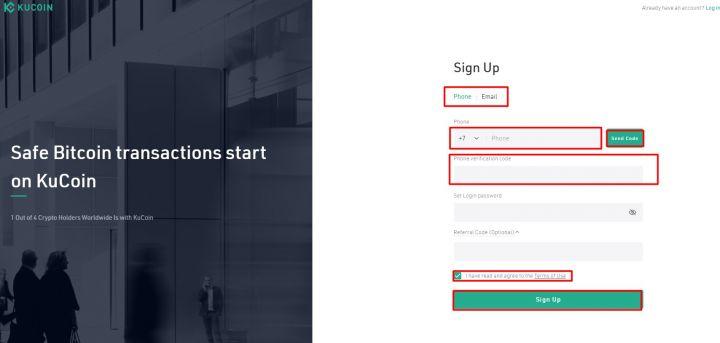

How To Open A KuCoin Account?

Click the “Go To KuCoin Exchange” button above to go to KuCoin’s homepage. Once there, you will see a “Sign Up” button in the upper left corner.

Enter your email or phone number and a strong password consisting of capital and lower-case letters and numbers. Hit “Send Code” and check your email or phone for a verification code, which must be entered below, too.

Then, check the mark that you agree with Kucoins terms of use, hit “Next,” complete captcha, and you’re almost good to go. The last thing you need to do is to confirm your email address via the link they send to your inbox.

Cryptonews Kucoin referral code is: 2N1dNeQ

That’s it! Once you are on the exchange, you can either deposit some of your crypto funds or use KuCoin’s “Buy Crypto” feature to start trading.

Once you top your account, don’t forget about the KuCoin’s account security tools: spare some time to set up two-step authentication, security questions, and/or anti-phishing phrases. It is recommended to set up all of the available security options for the best possible protection.

As you can see, no KYC verification is required to deposit, place trades, and withdraw funds. The only limitation is that you won’t be allowed to withdraw more than 1 BTC per day.

If you need further assistance, reach out to the help desk or see the KuCoin FAQ section or contact the support desk.

KuCoin Review: Conclusion

KuCoin is an ambitious and innovative player in the crypto space. The exchange has experienced significant growth since its inception in 2017 and is now amongst the top industry’s players in terms of security, reliability, service quality, and features. As such, the exchange is best suited for both new and experienced traders who want exposure to popular as well as less-known small-cap crypto tokens and assets.

Summary

- Web address: KuCoin

- Support contact: Link

- Main location: Seychelles

- Daily volume: 11877 BTC

- Mobile app available: Yes

- Is decentralized: No

- Parent Company: Mek Global Limited

- Transfer types: Credit Card, Debit Card, Crypto Transfer

- Supported fiat: USD, EUR, GBP, AUD +

- Supported pairs: 456

- Has token: KCS

- Fees: Very Low